Credit Karma Also Monitors Dark Web Data

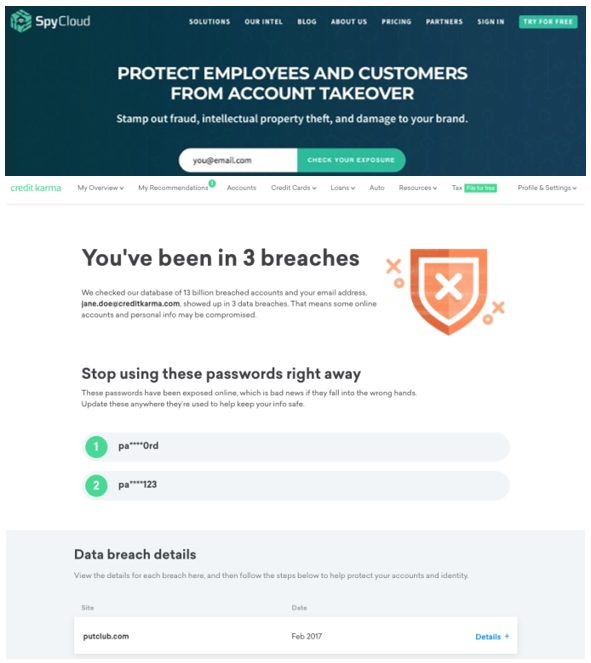

Credit Karma is expanding their service for monitoring personal data through including information exchanged on the “Dark Web”. This US FinTech partners with SpyCloud –which specialises in sending warnings when customers’ accounts are stolen or tampered with. It helps them secure their personal and financial data.

This initiative is being announced one month after Credit Karma integrated a free ID Monitoring service, available from their mobile app and website. It provides the user with a tracking solution and with and advice (identifying compromised passwords, helping customers reset them, etc.). It also warns them via e-mail if their personal or banking information is being fraudulently used.

From now on, this FinTech is expanding their fraud prevention analytics services to encompass personal information spotted on the Dark Web. To do so, they rely on databases exploited by SpyCloud to identify significant amounts of compromised information (their own database already includes 80 million users). This base mostly covers sales of credit card numbers.

With this service, Credit Karma tries to reassure their customers as regards to identity usurpation risks. They consider this information necessary to improve consumers’ awareness and help them understand they are exposed on the Web.

Comments – Personal data, a central preocupation

SpyCloud provides alert systems to companies so they can prevent account takeovers and other compromising for their employees and customers. This service is all the more relevant that personal data thefts have become increasingly frequent. With this tool, Credit Karma is hoping to attract roughly 13 billion hacked elements (vs 3 times fewer with their initial service).

In the US, this service is being introduced as massive data breaches keep headlining the news, as with the Equifax case disclosed in September 2017, which stained the image of one of the most famous US credit rating agencies. Credit Karma intends to stand out while reassuring their customers, increase awareness of risks.

Also, this topic is all the more an issue that connected devices are increasingly gaining grounds. They even became a priority for the largest tech companies (Google, Apple, Facebook, Amazon) and payment players (Anytime, Mastercard/Visa,). These new use cases raise questions as to protecting personal and banking data, and their use for commercial purposes, and cybercriminal ends.