Consumer Credit: A Chatbot for DKB

The Berlin-based online bank Deutsche Kreditbank (DKB) partners with a FinTech, FinReach, on launching a new virtual assistant. This chabot is meant to assist consumers in dealing with their loan application processes, making it easier for them to access consumer credit facilities.

FinReach emerged from the Berlin FinTech incubator FinLeap. It specialises in crafting SaaS solutions for financial institutions. It is already in charge of handling automatic customer account transfers for Deutsche Kreditbank when customers want to change bank. The institution now also trusts this start-up with rolling out their chatbot.

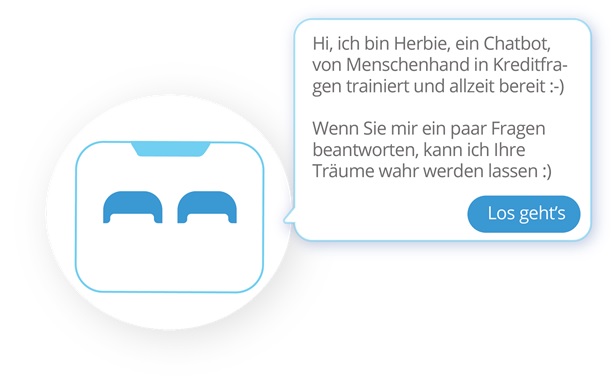

This tool called “Herbie” pops up every time customers visit their website. It is displayed at the bottom right-hand corner of the page and instantly detects prospective customers’ interest in a financial product. Tests are still underway and Herbie mostly assists users with applying for personal loans.

Herbie relies on Artificial Intelligence and natural language to converse with the users. It is mainly intended to guide them, provide answer to their questions and assist them throughout their application process.

Comments – Chatbots become mainstream, and in the credit industry too

Chatbots and other smart assistants soon started to rely on instant messaging services. Some banks remain sceptical when it comes to adapting these tools to their CRM needs, but others have begun to make the switch. Bayerische LandesBank’s online subsidiary proposes this new service in response to increasing demand on the part of their customers, more likely to prefer messaging interfaces over other communication methods.

As regards to consumer credit, many announcements have already been made. Six months ago, Yelloan launched the first French conversational chatbot for consumer credit in partnership with Financo. And, in India, YES BANK allowed their customers to apply for loans through a Facebook Messenger chatbot.

DKB’s service stands out as it can detect users’ interest in given products in real time. It can also lead the conversation based on their specific needs.