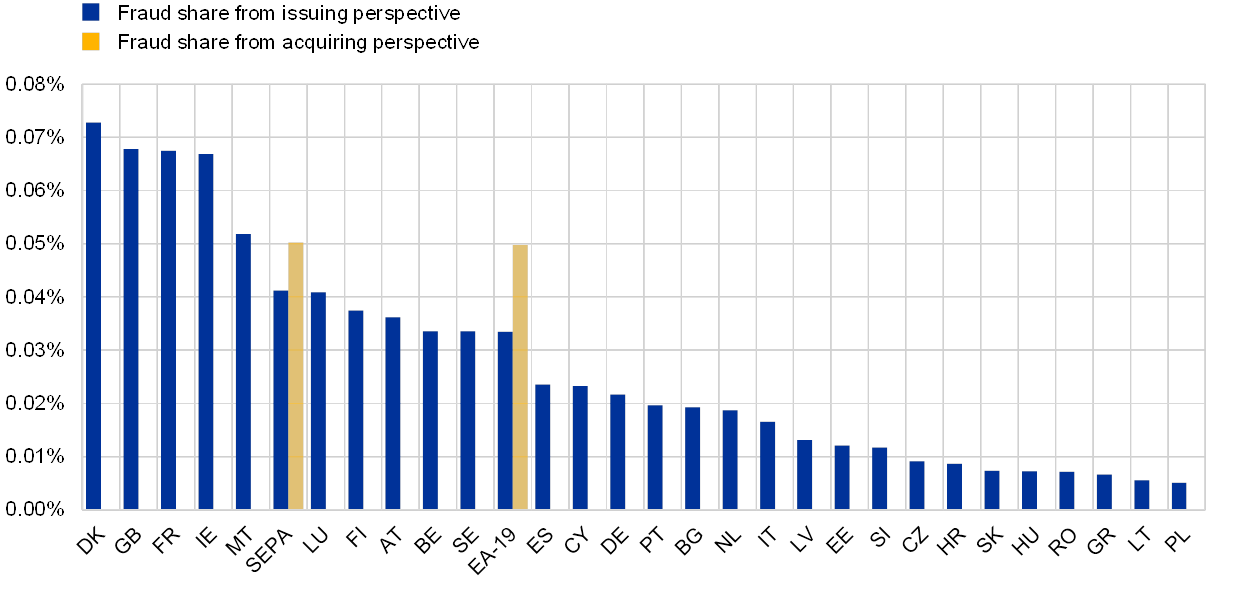

Card Fraud: France Still in Top 3 of Main Targets in Europe

Card fraud-related losses in Europe significantly decreased between 2012 and 2016 as authentication measures improved. The ECB just released their 5th oversight report, highlighting a 0.4% reduction compared to 2015. Even if fraud rates also slightly dropped in France, it remains in the top 3 of most affected countries in Europe.

ECB figures showed overall losses of € 1.8 billion in Europe throughout 2016 (- 0.4% compared to 2015). CNP payments only consists in roughly 13% of combined transaction values, it accounts for 73% of card fraud losses. Also, 19% of the overall amount would relate to in-store transactions and 8% to ATM fraud.

CNP fraud figures EU-wide increased by +2.1% in 2016 as the e-commerce sector kept growing in Europe. E-payment-related fraud still evolve less steadily than the previous years.

On average, French people hold 1.18 payment card (compared to 1.53 SEPA-wide) and each cardholder makes 164 transactions each year, for a total of €8,043 (vs €16,678 for 291 transactions in the UK, and €12,285 for 329 transactions in Denmark). Still, in France 69 fraud cases are recorded every 1,000 cards, compared to 22 every 1,000 SEPA-wide.

Comments – Fraud losses: cards becoming less exposed?

The slight drop in card fraud loses and stable values regarding new card-based means of payment, in a context witnessing growth in payment flows, stresses efforts on the part of industry players to secure transactions. This promising indicator contributes to developing innovative payment methods and alternative solutions. Yet, the increasing use of mobile devices is enticing additional risks, that will need (and already do need) monitoring.

In France, much work remains to match European figures. Many initiatives are being conducted, including new fraud prevention platforms, such as Thésée (helping victims of online scams) or Perceval (cybercrime prevention service by the French Gendarmerie) which recorded roughly 18,000 online notifications in just three months.