Budget Insight delivers on its vision of Open Finance internationally

Following its exit from the Crédit Mutuel Arkéa fold, Budget Insight is implementing the strategic shift it announced by turning resolutely towards the international market. The PSG fund has given the company this opportunity, notably by allocating funds to finance acquisitions abroad. This move is essential to position itself in the face of increasingly powerful open-banking players with very extensive connections.

FACTS

-

Budget Insight's new achievements include extensive expansion projects for its activities.

-

First of all in terms of internationalisation. Budget Insight has just made its payment API and account aggregation service available in new countries, namely Italy, Spain, the United Kingdom and Germany.

-

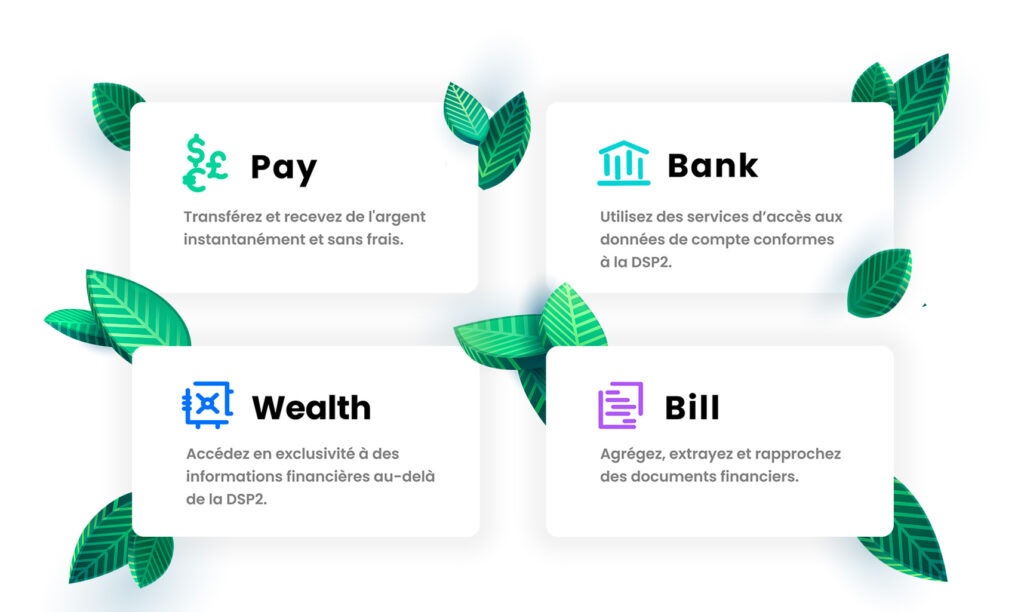

But also in terms of diversification of its services, beyond the European concerns of the PSD2. The FinTech is therefore making official today :

-

Its integration of the main crypto-asset and trading platforms: Coinbase, Binance, Bitpanda, eToro, Trade Republic, Mon Petit Placement and Kraken, which will later be joined by other platforms.

-

its wider opening towards credit. While Budget Insight already facilitated the analysis of financial data through a connection to the account (with Finfrog or Algoan, for example), it now also collects legal and financial information on companies available on Pappers (from INSEE, INPI and BODACC), as well as payslips (from the MyPeopleDoc, Pagga (Lucca), Primobox and ENSAP electronic safes).

CHALLENGES

-

Fundraising to fuel its international growth: Budget Insight raised $35 million last April when it joined the PSG portfolio. These funds will be used in particular to finance the internationalisation underway today. The fintech is now reporting much wider coverage (around 90%) in Spain and Italy. As for payment initiation, it is now offered in Italy, the UK and Germany.

-

A shift towards Open Finance: with the new functionalities announced today, Budget Insight confirms its desire to extend its activities by addressing much more varied use cases. This is the case for KYB, which is now offered with Pappers, via a feature called Bill. Finally, Budget Insight has also announced the launch of Wealth in Italy, a solution for aggregating savings and securities accounts.

MARKET PERSPECTIVE

-

By 2021, Budget Insight had achieved a 44% growth in turnover. It expects to be between 40 and 50% again this year, with recurring revenues that could amount to €10 million.