BPCE Partners with Meniga

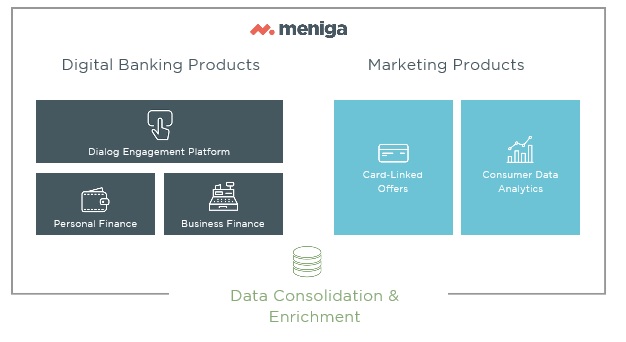

BPCE announced a partnership with the PFM specialist Meniga during the Paris FinTech Forum. This agreement is described as strictly technological, but highlights the group’s expectations as regards to the Open Banking trend and their digital transformation strategy.

BPCE refers to their partnership with Meniga as a technological partnership. They would be relying on Meniga’s expertise to speed up the pace of their in-progress digital transformation, and contribute to the changes their plan to apply to some of their services.

At first, budget management features will be included by the bank: financial activity feed, real-time spending overview, customised alerts and insights. The idea is to propose value-added services to BCPE customers.

This announcement also materialises the ambitions outlined by the group in their TEC 2020 Strategic Plan.

Comments – BPCE familiar with the Open Banking challenge

BPCE stands out as one of the longstanding institutions most familiar with the challenges entailed by the Open Banking trend, as well as with the underway digital revolution. This new partnership further stresses their pragmatism. Caisses d’Epargne institutions are already proposing an in-house account aggregation feature added to their Banxo mobile app. Yet, François Pérol claimed that Meniga was “better”, which of course, accounts for their choice.

Pragmatic ambitions for BPCE

Upon announcing the BPCE / Meniga agreement, François Pérol also explained that Fidor –whose French launch was expected to happen in 2018– will not be rolled out in banking format as initially intended.

BPCE would rather favour a service which derives from PSD2-born opportunities, probably closer to the model they selected for Max, than an actual alternative bank. This new launch could lead them to propose an account aggregation service, a personal banking coach, or even a marketplace, via integrating service blocks (APIs) crafted upstream by other players. According to some observers, besides the high cost of launching a “real” bank, the main obstacle could lie in their fear that they might interfere with their historical network’s activity.