Banco Sabadell's turn to geolocation payments

The geolocalized data analysis company Snowdrop Solutions just found a new large banking partner to deploy its technology. This is Banco. Sabadell which is thus about to evolve the digital experience of its customers by allowing them to geolocalise their card payment in real time.

FACTS

- Banco Sabadell has recently announced its strategic partnership with a leader in technology services based on Snowdrop Solutions geolocation.

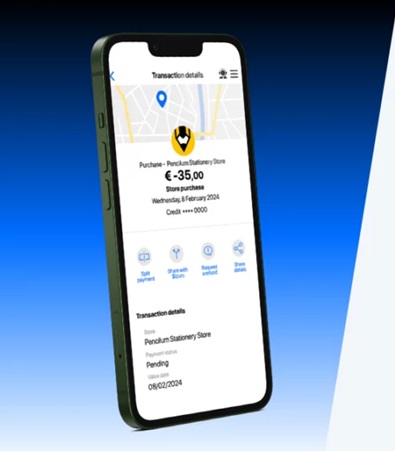

- The Spanish bank is now planning to integrate the MRS APi transaction data enrichment technology from Snowdrop Solutions to enrich its own services to its end customers. They will now be able to view the location of their card transactions and the names and logos of the institutions with which they have operated.

- Banco Sabadell presents this new service enrichment as a way to facilitate the tracking of their expenses for its customers.

- The geolocation services provided by Google Maps from Snowdrop Solutions also allow a map to be displayed to ensure maximum access to location data.

ISSUES

- Information for the benefit of experience Banco Sabadell and its partner Snowdrop Solutions are again demonstrating the value of providing as much information as possible to clients of banking institutions. The geolocation of their transactions must in this case make it possible to optimise the monitoring of the expenditure of the users of the service, and finally to improve the experience of the customers in the application of the bank.

- Tools to fight fraud better The deployment of this solution is also largely aimed at improving the fight against fraud. Better informed, Banco Sabadell customers will be able to identify potentially problematic transactions more quickly and certainly.

PERSPECTIVE

- This is not the first time Snowdrop Solutions has found a bank partner to deploy its services and technology. In October 2023, it was the Spanish digital bank Evo Banco, a subsidiary of Bankinter, which submitted a new operations contextualization service. At the time, geolocation, artificial intelligence, and Google Maps were used to present the bank's customers with the exact time and location of their transactions.

- Improving the readability and monitoring of transactions is a major issue that is not only defended by Spanish banks and their technological partners. In October 2024, the US payment giant Visa relied on the European FinTech Tink for start a new feature called Merchant Information. The aim was then to enable consumers to obtain additional information on the traders from which they made their purchases.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate