ABN Amro’s Tikkie Gets New Features

The Dutch bank ABN Amro keeps enhancing their credit transfer-based mobile payment solution. Tikkie started aiming for in-store payments more than a year ago and a major update has just been announced. Several new features and improvements are being added for both individual and corporate customers.

Tikkie’s users will no longer have to wait for a payment request or need to key in an IBAN to transfer money. Their mobile phone numbers will be used to identify them: they may then choose a recipient from their contact list and initiate a transfer.

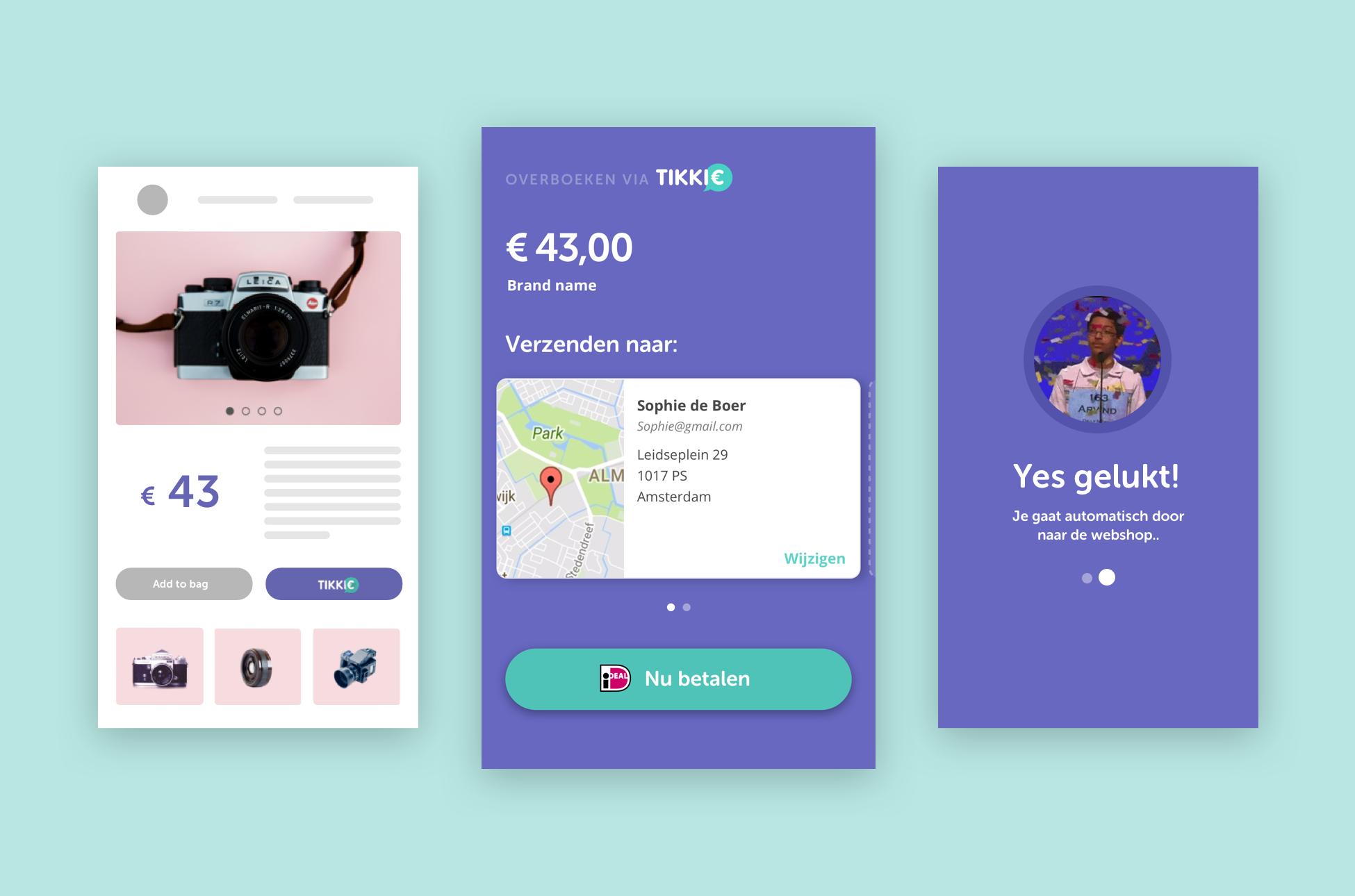

Also, Tikkie intends to implement an express checkout service for this new version. The option called SuperSnelBetalen is meant to simplify purchasing processes for e-merchants and e-buyers. The service features a one-click payment system, where no credentials or shipping information needs to be specified: this data has already been stored within Tikkie.

In addition, a new app for businesses should soon see the day, allowing them to initiate higher amount transactions. Tikkie corporate users will be able to customise the interface (add their logo and apply their graphic charter.

Comments – Diversification underway, Tikkie lays roots

With this announcement, Tikkie once again shows how crafting a P2P transfer solution can bring about new opportunities. This service was initially meant as a payment feature for social messaging platforms. The app now counts more than 4 million users and roughly 2,000 corporate customers in the Netherlands. Tikkie further stresses how successful a credit transfer based solution can be.

These new offers are in line with the Dutch bank’s intent to lead to mobile payment market with high added-value offers. Mobile phone numbers are then used rather than the customers’ IBAN, which should significantly streamline P2P transfer processes. Also, SuperSnelBetalen could help merchants increase their conversion rates and customer satisfaction. Eventually, BtoB targets are key to making this solution profitable: adjustments must be made to meet their specific needs.