Zurich Trials Customised Car Insurance Offers in Spain

FACTS

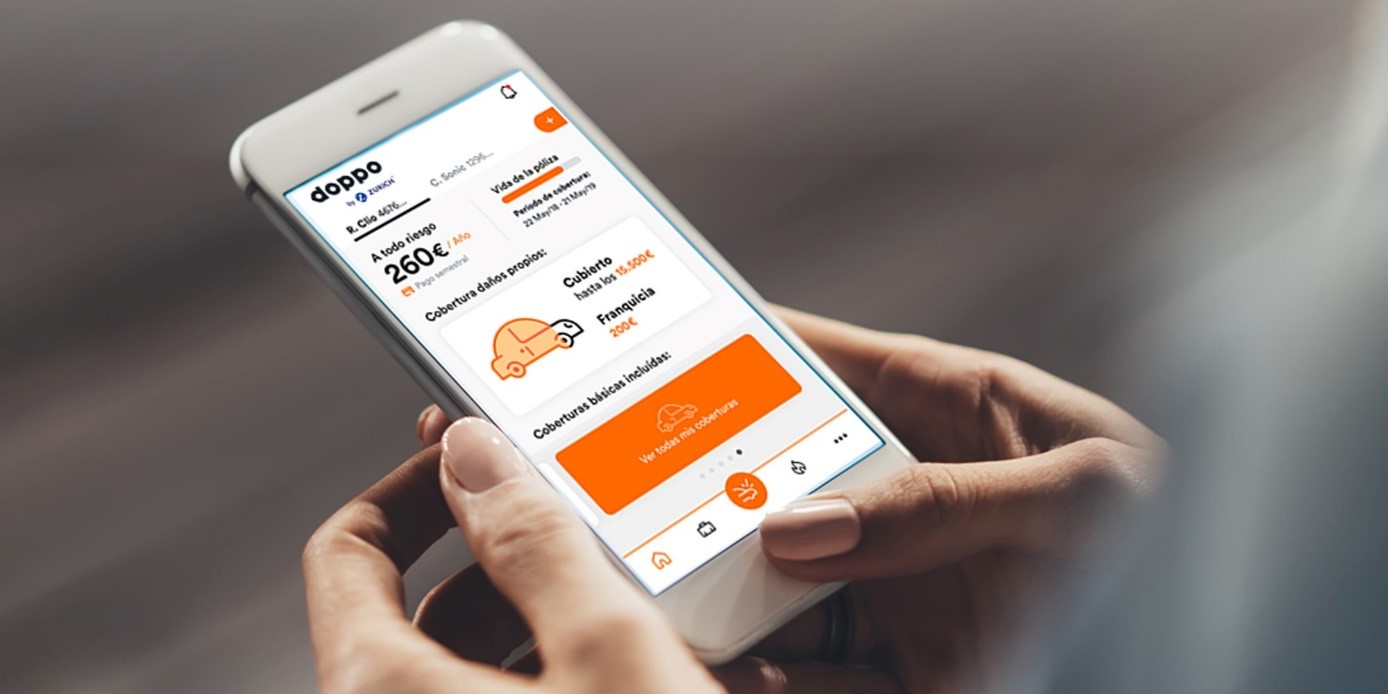

- Doppo by Zurich –leading digital and mobile insurance company in Spain– tests for a scalable car insurance offer.

- Whom for? Urban customers expressing expectations for flexible, autonomous offers.

- Full-digital customer process:

- Quotes,

- Digital signing,

- Premiums payments,

- Online or in-app contract management processes (ex: issuing insurance certificates),

- Remote video inspection of the vehicle.

- Three insurance coverage options:

- Expanded Third Parties (€200.94/year for a 2018 SEAT Leon)

- All-risks and scalable (€261.84/year)

- All-risks (€302.87/year)

- The tailor-made option stands out as it empowers insured parties to specify the value of their car, without taking official price ranges into account. They may then configure their coverage using a perceived value of the vehicle. Insured parties may also add or remove coverage options, leading insurance premiums to vary.

CHALLENGES

- Testing a new business model in Spain. Zurich deems that emergence of electric cars, autonomous vehicles and even ride-sharing services are as many trends inducing deep changes in the insurance sector. Hence their intent to craft, as a start-up would, a subsidiary for testing new insurance models, and insisting on a scalable approach.

- Making adjustments to meet new car consumption models. These trends also cause customers’ perception to evolve. Doppo by Zurich is meant to address these changes, add more flexibility in choosing insurance offers, and enable customers to set their own risk levels.

MARKET PERSPECTIVE

- If successful in Spain, Doppo by Zurich could end up being featured on other markets.

- With a relatively similar approach in mind, in April 2019, Garanti Bank introduced a scalable health insurance offer based on insured parties’ specific needs.