With Aiia, MasterCard consolidates its Open Banking positioning

MasterCard has announced the acquisition of Aiia, a Danish company specialized in Open Banking technologies. This is a new step in a long-run strategy.

THE FACTS

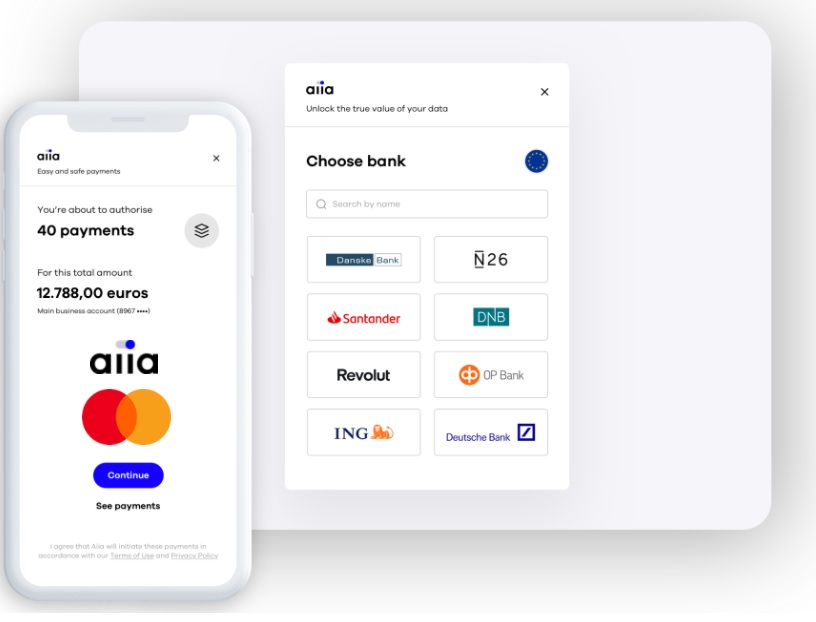

- MasterCard has announced its acquisition of Aiia, a leading European provider of Open Banking technology (Payment Initiation Services (PISP) and Account Information Services (AISP) operating under the supervision of the Danish Financial Supervisory Authority (FSA).

- At the heart of Aiia's offering is a unique API capable of providing a direct connection to more than 2,700 banks across Europe to its customers (banks, fintechs and payment companies).

- MasterCard is taking on a major role with Aiia as part of this acquisition. The scheme plans to provide its technology, connectivity and data infrastructure platforms, combined with data privacy and security principles.

- MasterCard's acquisition of Aiia will still need to receive approval from the relevant authorities. It is expected to be finalized by the end of the year for an undisclosed amount.

CHALLENGES

- Enriching the ecosystem: MasterCard is counting on the multiplication of acquisitions to offer a complete range of services. The group will provide Finicity's credit rating applications to European customers. The aim is also to create bridges between MasterCard's European and American Open Banking services to offer an ecosystem of services open to the international market.

- Enhancing its status, beyond the scheme: The American scheme seeks to establish itself by taking a central role in the Open Banking ecosystem, as a trusted intermediary and secure data network. Mastercard is thus still seeking to create a data exchange standard between banks, FinTech and customers.

- Reacting to the competition: The offer to buy out Tink by its competitor Visa last June locked up a large part of the open banking market in Europe, where Tink was the leader. With this takeover, it is therefore a question of leveling up in order to exist on this emerging market.

MARKET PERSPECTIVE

- In 2019, Mastercard launched its first open banking connectivity offering in the UK and Poland through a partnership with Token. In the same year, it acquired a division of Nets, the Danish electronic payments specialist.

- In June 2020, the American scheme also bought a FinTech in its country, Fincity, to strengthen its position in the Open Banking market.