WeChat Pay Values Data Analytics for Credit Scoring

Photo credits: TechNode

FACTS

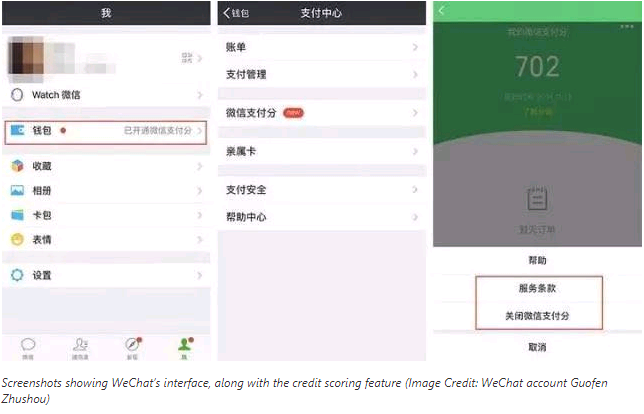

- The Chinese telecom leader Tencent recently started testing WeChat Pay Points: a new scoring tool using data retrieved via their WeChat Pay payment service.

- For now, this service is only tested in Beijing, Shanghai, Guangzhou and Shenzhen. It assesses the user’s creditworthiness based on various criteria

- His identity

- His consumption habit: analysing his WeChat Pay purchasing history

- His transaction history: analysing his WeChat Pay transactions

- This feature also scrutinises the customer’s interactions on social media, and it links with WeChat’s mini-programs, too.

- The users with high scores can be rewarded with perks such as favourable credit rates, waiving of deposits on rental services or hotel bookings.

CHALLENGES

- Enabling customers with no credit history to access to credit offers using data processed through Tencent’s social platform.

- Helping companies bring down risk levels based on an alternative scoring tool.

- Valuing huge amounts of user data retrieved through Tencent.

MARKET PERSPECTIVE

- As they still face competition from Ant Financial in China, WeChat Pay Points stands out as Tencent’s response to Sesame Credit, where very similar criteria are used to rate customers on a scale from 350 to 950.

- This new feature was introduced at their WeChat Open Class PRO event in January. Tencent aims to attract more than one billion Chinese customers by the end of 2019.

- This commitment from Chinese Tech giants is in line with local authorities’ intent to implement a system where governmental organisations share information as to their citizens’ creditworthiness, and may impose penalties based on assigned “social score”.

- The point is to improve customers’ access to credit offers in the country, beyond the 300 million people already addressed.

- In 2015, People’s Bank of China allowed 8 private companies –including Alibaba, Tencent and JD.com– to craft their own (private) credit rating platforms. Tencent arrives rather late on this market, as they launched WeChat Pay at a later point, and the data processed through this service is key to this scoring tool.