Volt turns card payments into money transfers

The British payment gateway Volt has just introduced a new payment service called Transformer. Its originality lies in its ability to create a unique link between payment by card and payment by transfer. A new way of initiating a "Pay By Bank" transfer.

FACTS

-

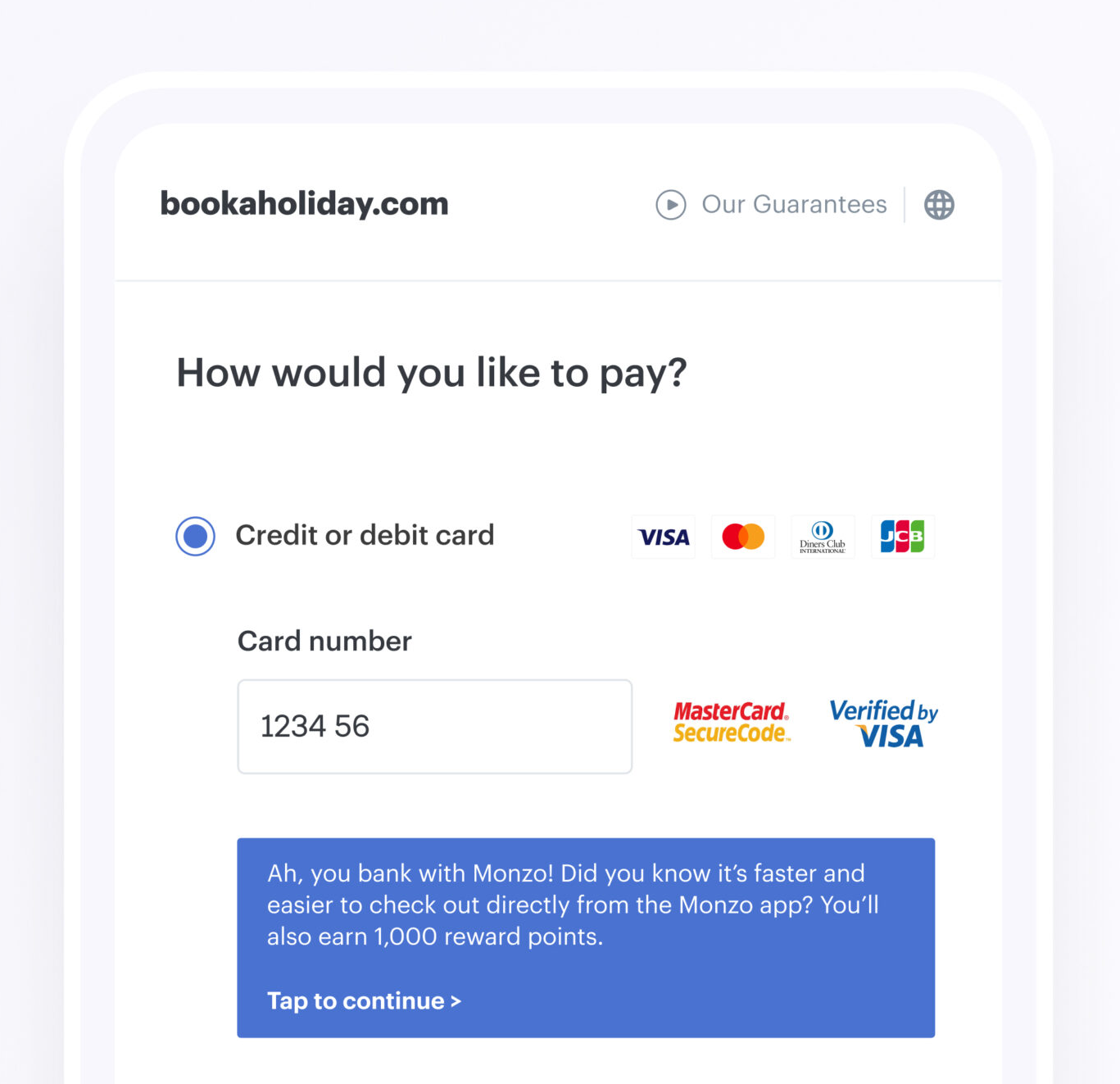

Transformer is an original solution for "diverting" a card payment initiated online, in order to transform it into a transfer payment.

-

This transformation takes place when the first digits of the card are entered when a customer decides to use it to pay for an online purchase; the first six digits corresponding to the bank identification number (BIN) allow Transformer to immediately identify the cardholder's bank. Transformer can then very simply offer to complete a transaction by bank transfer instead, in return for an incentive.

-

To do this, the customer is encouraged to accept this "transformation" by means of a reward of loyalty points to be used at his or her retailer's for example.

-

Transformer is particularly aimed at airlines, retailers, streaming services, car dealerships and other event companies.

-

Customer journey:

-

The consumer enters the first 6 digits of their card,

-

Volt automatically detects the cardholder's bank,

-

It sends the payment order to a "Pay By Bank" type transfer form, pre-filled with the identification of the customer's bank,

-

The customer validates this choice and is redirected to his banking application to authenticate himself,

-

He then validates the transaction.

-

CHALLENGES

-

Reducing transaction costs for the merchant: Volt's Transformer solution puts forward a value proposition based on the elimination of interchange fees for merchants accepting card payments. To justify this switch, Volt relies on rewards to give the end customer an objective reason to adopt this alternative payment method. It seems to be a big challenge to convince a user who initially left to use his card, but Volt is betting that the merchant will be a prescriber and that the end-user will be sufficiently motivated by the advantage granted by the merchant in exchange.

MARKET PERSPECTIVE

-

Volt continues to explore the possibilities of Open Banking in payment initiation, to establish itself as a leading open payment platform in the UK. For the record, Volt is based on the Pay By Bank instant payment service developed by VocaLink and acquired by Mastercard.

-

Another British start-up, Trilo, had chosen to encourage the end customer to push its payment by transfer solution.