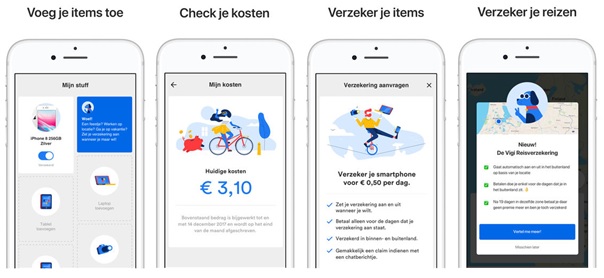

- Their first offer is meant for travellers (luggage, assistance in the event of an accident, medical expenses and 24/7 emergency phone number). This insurance policy is automatically activated when Vigi detects that the customer is abroad (via locating his smartphone).

- Cost: €1.30/day in Europe & €2.60/day outside of Europe; + €1.20/day for winter sports.

- The second offer covers breakage or theft of nomadic devices (cell phones, cameras, laptops, etc.). In this case, the insurance is activated in one tap by the customer.

- Ex.: €0.30 to ensure a cell phone during a festival; €2.50 to ensure a camera for a week-end.

- In both cases, the insurance option is enabled at least for a day. From the app, the user may visualise his insurance service, apply changes at any time, and file claims. And customer support can be reached via the app, too. For now, Vigi is only available from the App Store.

CHALLENGES

- With this on-demand insurance platform, VIVAT enables access to more flexible insurance offers, based on their customers’ actual needs. Location technologies are used to automatically start the insurance option.

- Transferring skills from VIVAT to Vigi. VIVAT is a regular insurance company but, even if they see InsurTechs as threats, they also acknowledge their potential. This observation led them to build their own InsurTech and, over time, rely on a new model.

- Aiming for younger customers. Through its specific model, Vigi is a means for VIVAT to aim for Millennials, study their behaviour, their insurance choices, the way they interact with their mobile devices and other items.

MARKET PERSPECTIVE

- Vigi was built as an "intrapreneurship" project at VIVAT. A pilot phase is still underway and changes are made based on the data it retrieves. The Dutch insurance company does, however, intend to feature other products to expand Vigi’s set of services.

- Several test phases have been conducted in Europe as more players look into on-demand insurance options. In France, Maif (via their subsidiary Altima) launched Valoo in 2018: a similar service for insuring goods. On a different note, the British FinTech Cuvva proposes a per-hour insurance feature for occasional drivers. And Revolut launched a location-based travel insurance where prices match actual use cases to streamline customer experience.

Video: https://www.youtube.com/watch?v=l_e3diN40M4