Visa wants to make digital payments interoperable

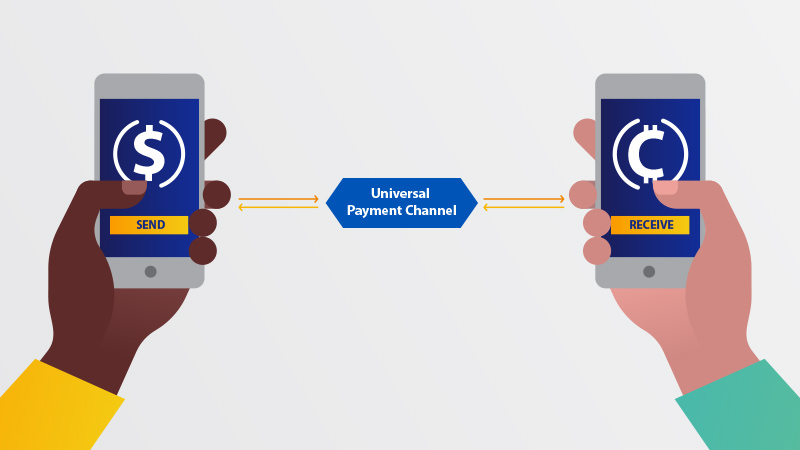

Digital payments have undoubtedly transformed the world of commerce, but the sheer number of payment apps has hindered consumers' ability to send money between users seamlessly and easily. Visa is developing a new interoperable peer-to-peer (P2P) payment service that allows consumers to send money to friends, even if they use another payment service.

FACTS

-

A new service called Visa+ has been developed to enable interoperability between different money transfer solutions.

-

Visa plans to enable money transfers between Venmo and PayPal in the United States. It will be possible after Venmo and PayPal in the United States are integrated into Visa+. :

-

When Visa+ is enabled, users do not need to link their Visa cards to their accounts to make PayPal/Venmo transactions,

-

Visa acts only as a connection infrastructure and gateway between the two services,

-

Users set their own payment ID linked to their PayPal or Venmo account and can share it with anyone who wants to receive payment.

-

-

Other companies joining Visa+ include Western Union, TabaPay, i2C and DailyPay.

-

Visa has announced plans to offer Visa+ to consumers later this year, with general availability in mid-2024.

CHALLENGES

-

Enabling payment interoperability between Paypal and Venmo: While PayPal, which already owns Venmo via its former parent company eBay's purchase of Braintree a decade ago, has not been able to transfer money in real time between the two services.Visa is committed to making the two services interoperable.

-

A consortium that will expand over time: Visa says it will expand Visa+ to a variety of use cases aimed at content creators and marketplaces.

-

Allowing consumers to stop sharing personal data: A unique payment identifier means consumers will no longer need to share phone numbers, email addresses or other personal information. This is especially useful for one-time payments between people who are unlikely to interact in the future.

MARKET PERSPECTIVE

-

With interoperability becoming a real key issue in the digital landscape, including payments, the Linux Foundation recently launched the Open Wallet Foundation to support interoperability between digital wallets.

-

In the marketplace, empowering consumers is becoming increasingly essential to delivering the best customer experience. Despite a real paradox in the market between the need for security (especially via identity) and an enhanced customer experience, via hybrid payment solutions or frictionless payments, as seen with click-to-pay.

-

Payment remains a moving, innovative ecosystem, and is increasingly at the heart of the strategy of retailers and the financial sector. To offer this enhanced customer experience, but also to retrieve key data to optimize marketing strategies.