US-Born Unicorn Plaid Enters the French Market

FACTS

- The American FinTech Plaid announces their Beta launch in France, as well as in Spain and in Ireland.

- Goel: boost their European presence.

- Plaid was launched in 2012 in San Francisco. They recently opened offices in New York, in Salt Lake City and in London.

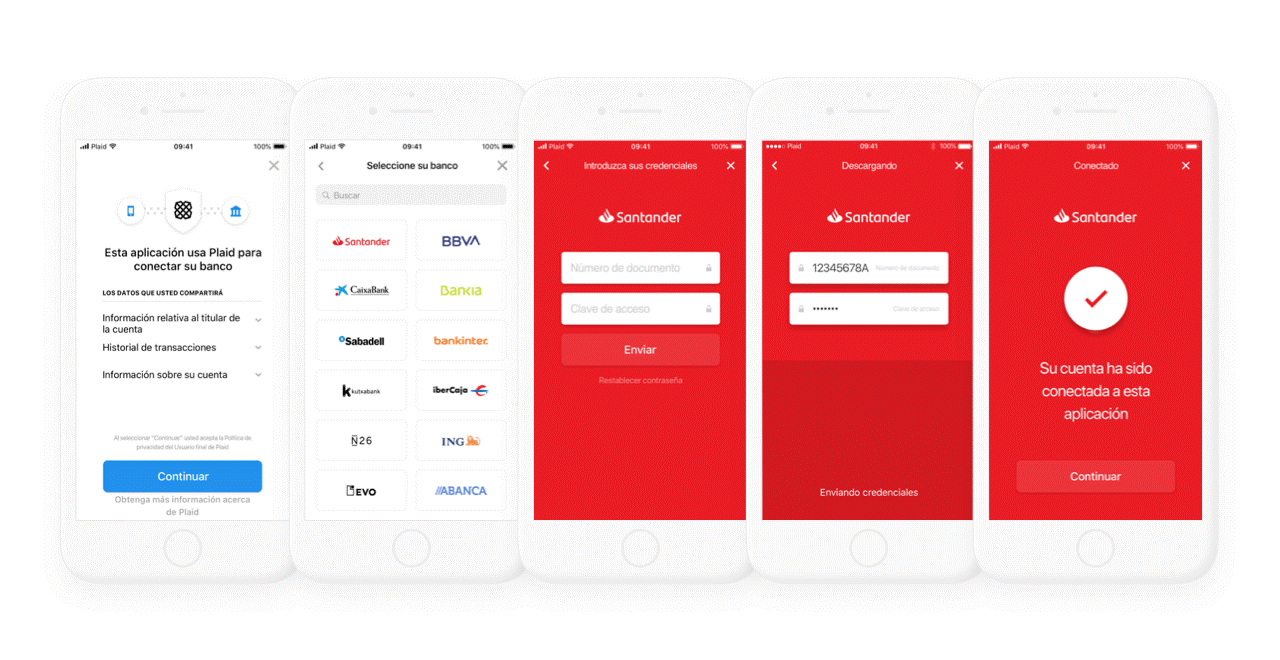

- Their platform provides developers with access to a global financial network. The point is to help them design innovative products and services locally and also sell these services abroad. As an aggregation service, Plaid acts as an interface between FinTechs and banks, relying on their access to bank accounts.

- Targets: Their solution is meant for finance industry players, providing them with access to consumers’ financial data (if customers have agreed to share it).

- Plaid bets on an established network in the US, in Canada and in the UK to help French FinTechs further aim for international reach.

- This launch will be relying on test clients: La Banque Postale, BNP Paribas, Société Générale and N26. French FinTechs will then be given instant access to more than 80% of the current accounts in the country.

Plaid: Key Figures

- 15, 000 banks in North America and in Europe.

- ¼ of the consumers with a bank account relied on Plaid’s services for connecting to apps.

- $310M raised.

- Current valuation: $2.65B

CHALLENGES

- High potential market. More than 320 FinTechs are established in France. And they raised over €368 million in 2018 (+15% compared to 2017). More than half of these FinTechs feature BtoB or BtoBtoC services for banks, insurance groups or other start-ups.

- Favourable environment. Through this expansion, Plaid hopes they can make the more of the new European regulation on Open Banking implementation. Besides French banks, they will also integrate with Irish institutions (AIB, UIster Bank and Bank of Ireland), and with Spanish banks (BBVA, Caixa and Santander).

MARKET PERSPECTIVE

- This American unicorn entered Europe starting in the UK earlier this year.

- They achieved unicorn status after they raised $250 million in December 2018.

- As they focus on gaining ground in Europe, Plaid will be challenging the British FinTech Bud. Bud raised $20 million in February 2019 and also features an Open Banking platform, enabling banks to connect their apps and data with other FinTech players.