Topi combines financing with BtoB payments

Berlin-based FinTech Topi has just raised its first round of funding to bring to fruition a payment solution specifically designed to manage transactions between professionals. It combines instant payment functionalities with financing offers and promises improved cash management.

FACTS

-

Topi has just raised $4.5 million in a pre-seed financing round from investors including Index Ventures and Creandum.

-

The FinTech is behind a new B2B payment solution that aims to be innovative in its ability to organise commercial exchanges more smoothly and conveniently.

-

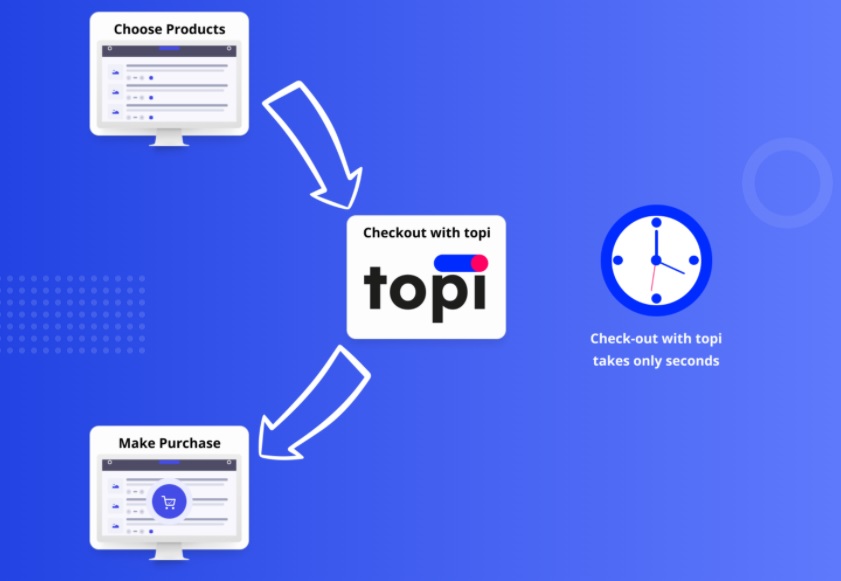

It has developed a payment model capable of managing the entire B2B sales process in a 100% digital manner. Users of its service will be able to make payments quickly, without receipts, by combining it with financing offers.

-

Topi will offer financing for up to five years via an instant approval system.

-

The aim is to help companies pay for costly but urgent purchases, such as when a production machine breaks down.

CHALLENGES

-

Underserved needs: While in the B2C consumer space, payment options, debit or credit, digital wallets, insurance and BNPL options are becoming more common, the B2B sector remains largely untapped. The B2B payment solutions market is worth $120 trillion and will be five times the size of the FMCG payments market by 2028.

-

Tailoring offerings to individuals: When businesses make a purchase, especially an expensive item, they either have to cover the cost of that investment in full or go to the bank and ask for a loan. Outstanding amounts are much higher for a B2B purchase, which increases the risk. However, Topi's aim is to offer a solution that is as user-friendly as those offered in the B2B world, with almost instantaneous decision-making.

MARKET PERSPECTIVE

-

The creators of Topi come from Apple and Goldman Sachs. This association illustrates the potential of the alliance of forces between technology specialists and more traditional financial institutions in the renewal of financial services offers.

-

Topi also illustrates the potential of Open Banking. In order to grant instant financing and validate payments via its service without a receipt, Topi will rely on the automated analysis of a mass of data from other payment services or e-commerce sites (on Shopify, for example) generated by the companies using its service.

-

The FinTech is defending its European and even global ambitions for the deployment of its service.