Tinkoff Turns Bot into Day-to-Day Personal Assistant

FACTS

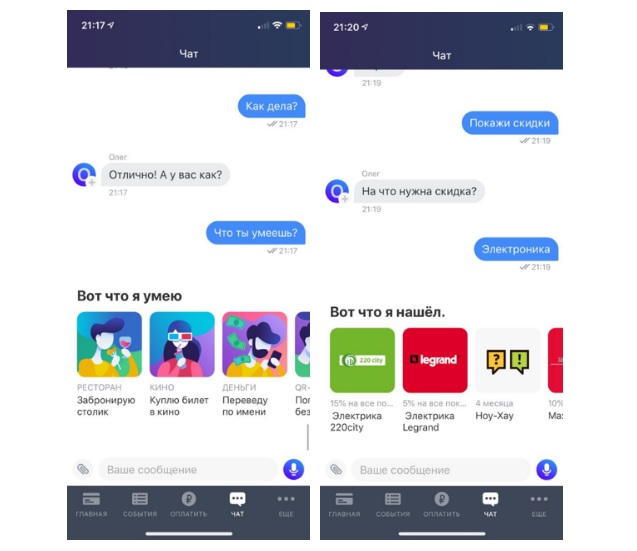

- The Russian bank Tinkoff introduces their financial bot Oleg and reshapes the associated mode. This service stands out as the first bot handling both banking and lifestyle questions.

- Oleg is a voice-based virtual assistant enabling its users to manage their personal finances, as well as day-to-day services.

- This bot has been added to the institution’s account management app.

- Features:

- Conduct credit transfers

- Book tables at restaurants

- Purchase movie tickets

- Enjoy discounts for goods and services

- Be provided financial information

- Order and send official documents

- Oleg’s features are expected to be further expanded as the bank wants to make adjustments to include all ecosystems: travels, leisure, finances, business and other day-to-day commutes.

- Biometric technologies should later on be integrated, as well, allowing customers to rely on voice recognition.

- And Machine Learning technologies should also contribute to improving Oleg over time.

CHALLENGES

- A banking bot and lifestyle assistant. Tinkoff doesn’t set any limit and will be adding as many services as possible for Oleg. The idea is to assist customers with handling day-to-day issues while improving customer relation.

- Tinkoff also provided their bot with a strong personality. Oleg takes on the voice of a famous Russian actor and has a sense of humour.

- Highlighting their technological advancement. Oleg is a proprietary banking solution entirely built by Tinkoff’s technological teams. This institution started working on AI techs back in 2014. They have been relying on their own voice recognition technology since 2016.

- Making a common technology stand out. Tinkoff lands quite late on the market for banking bots, but this delay can be accounted for by the scale of this ambitious project.

MARKET PERSPECTIVE

- Banking institutions contributed to boosting this new conversational model. Many players already tested their own bots with relatively similar features. Yet, the market has since become mature and more specific use cases started to see the day.

- In 2018, Tinkoff took a stake in Kassir, a company selling event tickets: Oleg becomes another interface for this service, which has been added to the bank’s range of offers almost a year ago.

- This focus on diversification has been quite specific to Tinkoff for years. Their business sectors already include the travel industry (via their subsidiary Tinkoff Travel). This peculiar identity is made clear by their founder who claims they created a “tech company with a banking licence”.