SWIFT Introduces a Fraud Prevention Service

Considering the ongoing surge in fraud figures, SWIFT further focuses on helping their members deal with fraud and cybercrime prevention. The interbank network with 11,000 members unveils a service for monitoring payments in real time.

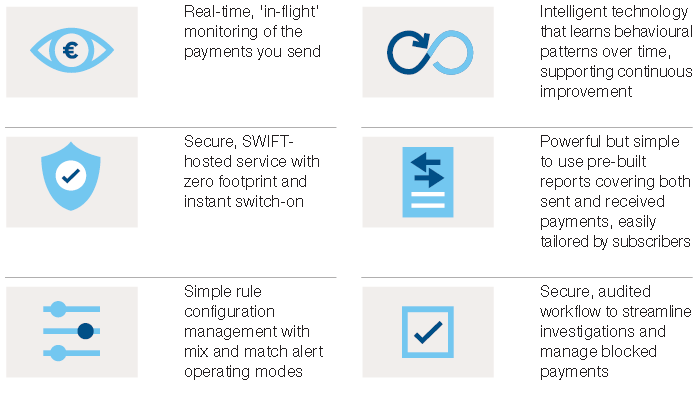

The solution called Payment Controls is chiefly meant for small financial institutions enabling them to monitor transactions in real time and on-the-fly. It complements their Customer Security Program (CSP), a community initiative launched roughly a year ago to assist SWIFT customers with preventing fraud and ensuring end to end security for their transaction processes.

The new feature addresses payment-associated risk management issues and uses predefined indicators based on customer companies’ specific policies and transaction history. This tool will spot potential irregularities and suspicious activities to trigger real-time alerts where payment messages that might not be compliant with in-place policies are highlighted. It can also block payments at any point along the process.

This Cloud-based solution is immediately available to SWIFT network’s users, without any software or hardware installation. It avoids that institutions should implement or maintain equipment in situ.

Comments – SWIFT focusing on payments security

Massive fraud cases keep headlining the news and SWIFT claims they want to play a decisive part in enhancing interbank ecosystem’s protection. The international messaging network is making adjustments to meet new cybersecurity requirements. Payment Controls is consistent with a series of launches meant to enhance trust among global players in the financial community.

With this fraud and cybercrime prevention service, SWIFT also strengthens their cross-border payment service’s security. gpi has been adopted by more than 150 financial institutions worldwide and could then attract even more members.

However not explicitly stated in SWIFT’s press release, this solution is likely based on Machine Learning algorithms, allowing it to comply with SWIFT’s user profiles and volumes. SWIFT also announced they recently processed interbank transactions sending payment orders via SAP on Azure, Microsoft’s Cloud platform.