SuperMoney Launches a Comparison Service for Student Loan Refinancing

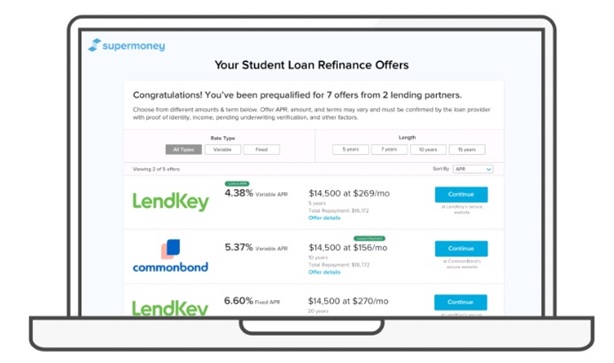

After launching their auto loan comparison website, SuperMoney unveils a comparison engine for student loan refinancing, allowing them to be sent customised quotes matching their specific financial situation, for free and in real time.

SuperMoney was founded in 2013 and now focuses on student loans, too, knowing that these targets account for the largest source of unsecured debt in the US, with outstanding loan amounts reaching $1.5 billion (in September this year). SuperMoney aggregates financial offers from industry specialists to provide students with an insight into the offers most likely to suit their actual financial situation.

Through a single application they are shown customised rates and prices near instantly. This process does not affect their credit scores. Also, they are informed of the amount of their monthly payments and overall cost of the new loan, if they were to choose any of the highlighted offers.

This engine aggregates offers from the main lenders aiming to help students achieve greater financial stability.

Comments – Student debt: an issue lenders try to solve

The amount of amount of student debt increased by more than 450% since 2001 in the US. This considered, This considered, several alternative players chose to focus on this sector through proposing PFM tools helping them to repay their loans faster. Personetics’ AI tech, for instance, feeds a module called DebtBuster.

SuperMoney for their part, features a comparison engines meant to integrate loan refinancing offers from industry specialists. The point is to assist these targets through their application processes via refinancing their existing loans at lower rates. Once their degree completed, their credit gets improved, enabling them to benefit from greater lending conditions. Yet, less than 50% of the Millennials with an ongoing student loan already looked into refinancing options. In this context, different players are focusing on this market: LendKey, LendingTree or SoFi, for instance.