SumUp presents its e-Wallet for individuals

A player in the BtoB payment market, SumUp has made a name for itself among British and even European FinTech over the years. It has been working for some time on diversifying its target market, but is now completing its ambitions by presenting SumUp Pay, its eWallet for individuals. The originality of the system lies in the complementarity between the two offers (BtoB and BtoC), with users naturally being encouraged to make purchases from merchants in the SumUp network. This strategy could well enable it to stand out from the major players such as PayPal.

FACTS

-

SumUp is launching a digital wallet with an integrated loyalty programme to strengthen support for local businesses.

-

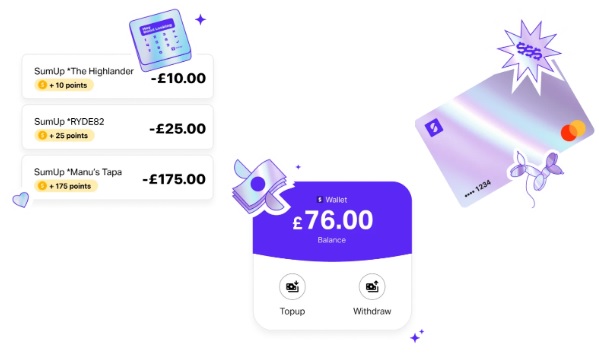

Called SumUp Pay, its new offering is indeed an e-Wallet to facilitate local purchases while boosting loyalty programmes.

-

Among its many features, the SumUp Pay application offers :

-

a virtual prepaid Mastercard, reloadable with a pre-registered card or by bank transfer (it allows users of the application to make purchases remotely or at physical points of sale and to make withdrawals)

-

Google Pay and Apple Pay,

-

a loyalty programme allowing users to collect rewards for spending with their SumUp Pay virtual card, topped up at SumUp merchants (points can then be redeemed at any local business accepting SumUp)

-

a secure one-click remote payment service at SumUp merchants,

-

a SumUp QR Code payment feature,

-

a payment service between individuals

-

a module for tracking all transactions.

-

-

The SumUp Pay application is available for free download in the UK, Germany and Italy.

CHALLENGES

-

Opening up to a new target: SumUp has made a name for itself by establishing itself among the reference players in mobile payment for small professionals. But today, its new offer is aimed at individuals, allowing the FinTech to diversify and open up to a new high-potential market. A positioning that should be facilitated by the fact that its BtoBtoC offers have already allowed it to familiarise itself with and make itself known to this new target. SumUp Pay nevertheless remains the first direct offer addressed to end consumers by SumUp.

-

An essential diversification to counter the impact of the economic crisis: SumUp Pay's loyalty programme aims at motivating the use of SumUp's services by merchants and allows SumUp to offer a new promotional tool for its offer to professionals. This link with its historical offer should enable it to attract private individuals and open up a new growth lever, in an unfavourable context. Since the beginning of the year, like many other payment players, it has seen its valuation plummet.

MARKET PERSPECTIVE

-

SumUp now serves over 4 million small businesses worldwide.

-

In June 2022, it also announced its latest funding round, totalling EUR 590 million. The FinTech has since been valued at nearly EUR 8 billion, instead of the EUR 20 billion estimated last January.