StellarFi makes credit scoring inclusive

StellarFi describes itself as a public benefit company founded in Texas to fight poverty. One of its recent initiatives is based on the deployment of a reverse scoring system, capable of helping the poorest Americans to access credit. This is being done in partnership with the major scoring organisations.

FACTS

-

The system developed by StellarFi is based on a simple concept. The company transmits to the main American scoring organisations (Experian, TransUnion and Equifax), evidence of the good financial management of the poorest Americans.

-

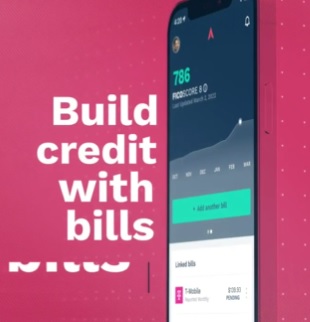

The main evidence provided by StellarFi is the payment of their rent, utilities, energy, streaming and other bills.

-

To obtain this evidence, StellarFi pays the bills on behalf of its customers and then goes back to them for reimbursement. If the latter pay their debt to StellarFi, it then declares their good-payment status to the official scoring organisations.

-

The system thus creates a positive payment history for Americans who are unable to obtain credit through the traditional system.

-

More than 40,000 applications that were previously on the waiting list are now being processed by StellarFi, enabling as many individuals to obtain credit for the first time.

-

The service is currently accessed through a web application, with a mobile application to be rolled out later this year.

-

StellarFi is a paid service, offered under three subscriptions, ranging from $4.99 to $19.99, which allow users of the service to add a specific or unlimited number of bills to be processed on their behalf.

CHALLENGES

-

Democratising credit: 132 million Americans currently have poor or no credit score. StellarFi has therefore worked to integrate new financial data that is equally reassuring to credit agencies to open up their scoring system and include more people.

-

Cash advance for individuals: Users of StellarFi's service are asked to pay their bills immediately to the company, but also have the option of delaying payment for 45 to 60 days.

-

Revisiting a paradox: The historical Anglo-Saxon credit scoring system is based on a paradox, since it allows citizens to improve their score as they repay their loans. In order to obtain a loan, one must therefore be able to prove one's status as a good borrower.

MARKET PERSPECTIVE

-

The redesign of Anglo-Saxon scoring systems has been in the news in recent years. Data and credit scoring giant Experian presented its Experian Boost service at the end of 2020 to integrate new data to improve scores.

-

This data includes energy bills, telephone bills and even other forms of subscription, such as Netflix or Amazon Prime. The service is now also offered by StellarFi, which is adding a cash advance system to improve its customers' financial situation as much as possible.