Starling Bank Adds an Income Protection Option

FACTS

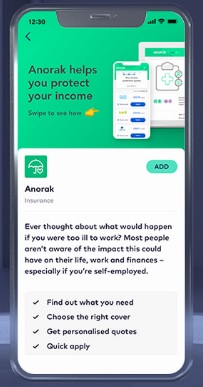

- Starling Bank‘s marketplace has been including Anorak since 2018. This FinTech built a robo-advisor for providing customers with advice on the best life-insurance offers based on their profiles and lifestyles.

- Their partnership is being expanded: Anorak now enables Starling Bank’s customers to subscribe insurance policies addressing income losses.

- Whom for? Freelancers and other self-employed workers.

- How it works

- From Starling Bank’s marketplace, customers start a diagnosis process by Anorak.

- Using Starling Bank’s API, the FinTech analyses the transactions they conducted from their bank account.

- Anorak recommends an income protection, defines the relevant amount and term for each customer.

- Anorak then features the contract most suited for each customer and lets them apply from Starling Bank’s mobile app.

“Two thirds (65%) of UK adults have no life insurance or other protection cover”

Source: FCA

CHALLENGES

- This launch should help Starling Bank expand their marketplace for financial services: they bet on an existing partnership to achieve this goal. They also aim for consumer segments more likely to be looking into challenger banks’ offers.

- Boosting their API distribution model. On their marketplace, Starling Bank changes a fee for making their APIs available to their partners, providing them with access to customers’ financial information and enabling them to sell additional services.

- Anorak relies on a distribution channel which grants them access to already qualified customers.

MARKET PERSPECTIVE

- Anorak is used to this type of partnerships. In the UK, they also teamed up with Yolt, European account aggregation service by ING.

- Starling Bank has been trialling different models to further expand their business. Besides their marketplace (opening access to their customers’ data), they have also been crafting a Banking-as-a-Service offer. This white label infrastructure already attracted Raisin and Ditto, for instance.

- And Starling Bank just announced they managed to reach one million customers.