Santander helps to manage its clients' properties

Santander is adding new range of service offering. This financial and non-financial offer is called My Home Manager. It is designed to help homeowners manage their homes in a broad sense, not only in terms of their assets but also in terms of maintenance and energy improvements. It gives the bank a new way of engaging with its customers over the very long term.

FACTS

-

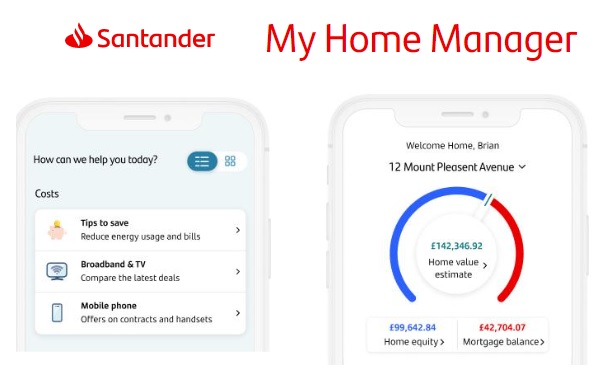

Santander has launched My Home Manager, a mobile application for homeowners and mortgage holders.

-

This new service is presented as a all-in-one for homeowners, capable of helping them manage their property in multiple ways:

-

financial: with a tool to check their loan balance and a service to estimate the value of their property updated every three months,

-

energy: thanks to a solution for checking the energy performance certificate (EPC) rating of their property,

-

maintenance: since the service also facilitates home repairs (free estimates from local craftsmen and follow-up of services),

-

furnishing: thanks to a module dedicated to furnishing and inspiring ideas for decoration.

-

-

Other features of the service include a home expenses manager, a tool for comparing digital offers (telephony and internet), a sales guide and a removal service, as well as tools to help improve the energy efficiency of homes by installing solar panels and electric vehicle chargers.

-

The service is to evolve continuously with the addition of new features. The "What's Next" tab on the application gives users a preview of upcoming features. They are invited to register for early access to these new services.

CHALLENGES

-

Extending the relationship and building loyalty: With its new service, Santander is moving beyond its role as a real estate financing organisation to provide broader support for its customers' projects, and is establishing itself as a partner in the day-to-day life of property owners over the very long term.

-

Optimising the investment of a lifetime: The purchase of a property represents the financial project of a lifetime for the majority of owner households. In addition to financing them, Santander becomes an extra-financial partner to its mortgage customers.

-

Acting in favour of energy efforts: By opening its service to the installation of solar panels and electric vehicle charging stations, Santander is once again acting on issues that go beyond financial matters alone. This approach even offers the bank an interesting dimension as an eco-responsible player.

MARKET PERSPECTIVE

-

Santander is opening up a new boulevard for the diversification of services around the home. In recent years, the main focus of bancassurance players has been on home assistance or risk and damage prevention, thanks to home automation.