REX: Successful Results for Orange Money

FACTS

- At a press conference in London, the French telco Orange reported successful results for their digital purse and further stressed a strategy gravitating towards financial services.

- Orange Money was launched ten years ago; it is now present in 17 countries. This service managed to exceed €26 billion in transactions over the past year.

- This mobile money transfer and payment solution for un(der)banked customers' claims 14 million active customers in Africa and a total of 40 million users.

- Goals: The French group intends to launch their mobile money solution in two or three new countries each year. Orange Money aims to achieve €800 million revenue in Africa and 30 million active customers by 2023.

CHALLENGES

- Orange Money will be a flagship product helping them achieve international expansion. The group reported discouraging results for their mobile bank, Orange Bank, but hope they can break even by 2023. This bank is also expected to launch in Spain, in Slovakia, Poland and Belgium.

- In addition to interoperability issues in the West African Economic and Monetary Union (UEMOA), Orange Money has also been affected by increasing fraud rates in this region.

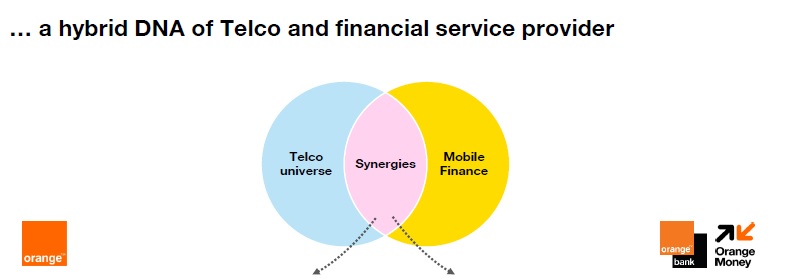

- These two offers still are strategic for the group, as they now consider themselves halfway between a telecom company and a financial service provider.

MARKET PERSPECTIVE

- Even if it leads its market in Africa, Orange Money has to face competition in these regions. A year ago, Société Générale launched a banking offer based on a mobile wallet for Sub-Saharan markets.

- This solution called Yup soon attracted 130,000 customers in Senegal (vs 1.9 million for Orange Money).

- By way of addressing competition from Orange, Société Générale intends to:

- Charge lower fees (ranging from 1 to 3% of the transferred amount)

- Implement mobile agents (vans) who would be travelling across the region to talk un(der)banked customers into choosing Yup

- Feature a micro-lending solution for Yup agents