REX: Banque Casino Claims 3 Million Customers

Photo credits: survey by OpinionWay – June 2019

FACTS

- Banque Casino reports strong results for the third year in a row. They now claim over 3 million customers.

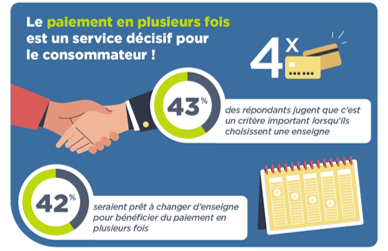

- This success can partly be accounted for by French customers’ interest in relying on instalment options: nearly 50% have opted for such features in everyday transactional contexts over the last year (source: survey by OpinionWay – June 2019).

- Besides, from a BtoB standpoint, they also build partnerships with a certain number of French e-merchants, including retailers and travel industry players (Cdiscount, Maeva, Pierre & Vacances Center Parcs, VideDressing.com, Orchestra, etc.) providing them with CB4X and CB10X services (for spreading card payments over 4 or 10 instalments).

- Key figures:

- 25% market share for their instalment option.

- 60% of their revenue from instalment options (the other 40% stem from their consumer lending business and from their payment cards).

- 700,000 cardholders and roughly 200,000 new cardholders each year.

CHALLENGES

- Gaining momentum as a FinTech and finding new growth relays. Banque Casino achieved this goal through multiple launches and considering French consumers’ new payment habits. They launched their “Coup de pouce” lending offer in 2017 and, more recently, an instant microcredit service available from Lydia and Bankin’ apps.

- Banque casino also plans to rely on accesses to banking data, taking advantage of PSD2-entailed opportunities, to simplify longer-term credit application processes. A test phase could be run next year.

- Different projects might help them make the most of their leading position on the market for instalment options, while also providing their solution, as a white label offer, to third parties and boosting their presence on the Credit-as-a-Service segment.

MARKET PERSPECTIVE

- Banque Casino faces several rivals in France (e.g.: Cofidis, Oney, Cetelem, Franfinance or Sofinco) also wanting to grasp shares of two successful industries: e-commerce and instalments.

- Banque Casino plans to launch instalment options across different countries in the euro zone in 2020. With a similar goal in mind, Oney took the lead and wants to stand out as the main digital challenger bank in Europe since their buyout by BCPE.

- Banque Casino makes much room for innovative projects, too: they just announced the integration of Apple Pay so their cards could be stored to this wallet, and they introduced a transactional chatbot.