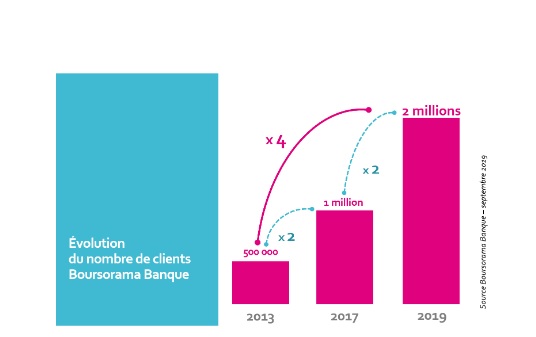

REX: 2M Customers for Boursorama

FACTS

- Boursorama (e-banking subsidiary of Société Générale) again reports highly encouraging results, breaking new grounds from last year’s record figures.

- Boursorama describes their new customer portfolio as the result of a record customer acquisition dynamic.

- Among key figures:

- 2 million customers (a figure they intended to hit in 2020),

- Recommendation rate: 48%,

- Cheapest bank (11th year in a row),

- 125,000 applications for Ultim cards in just 3 months,

- Digital experience considered 2.3 times better by customers than from other banks,

- +39% transactions carried out from checking accounts since the beginning of the year,

- +51% card-based operations abroad,

- 700,000 mobile payments in August 2019 and 100,000 instant credit transfers issued,

- +€2.5B in assets since the beginning of the year,

- +€1B in credit since the beginning of the year.

CHALLENGES

- Raising targets and further boosting customer acquisition. Considering these results, Boursorama plans to attract 3 million customers by 2021, taking the lead with an outstanding growth strategy.

- Besides, their customer satisfaction levels remain high, and they lead several rankings, e.g.: Bankin’ (looking into customer satisfaction rates and banking fees) and Meilleurebanque.com.

- Boursorama features free offers instead of trying to boost their profit. Their new payment card for free (including when making transactions abroad) has been key to their development in 2019. This cost-inducing strategy allows them to withstand competition from challenger banks.

MARKET PERSPECTIVE

- Boursorama says their upmarket Ultim card is essential to their growth strategy. They report 50% increase in customer acquisition rates over this summer (vs summer 2018).

- These results may also be accounted for by their overall customer acquisition strategy presented in September 2018, whereby they actually intended to attract 2 million customers by September the following year.

- This strategy had an impact on the competitive landscape, even causing some players to make adjustments. ING, for instance, started considering a less high-end positioning and featuring a fee-free, non-income-dependent offer.