Qred moves from credit to BtoB payments

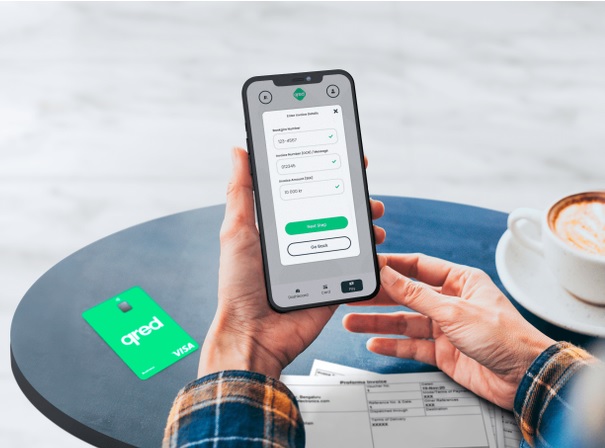

Swedish business credit platform Qred has announced the launch of a new simplified payment service that allows businesses to pay all their bills via their Qred card. The company is using its mobile application and the Swedish Bankgiro system.

FACTS

-

The Bankgiro system is an open payment system where each bank account is assigned a Bankgiro number. It aims to simplify payments between accounts.

-

Qred has therefore launched a new B2B payment platform that allows companies with a Qred card to pay any invoice via the Bankgiro system, even with beneficiaries who do not accept card payments.

-

Customer journey:

-

connect to the Qred application linked to their card,

-

click on the "pay" button,

-

fill in the payment details: recipient, bankgiro number (the Swedish bank account identifier), amount and date,

-

sign the payment order via BankiID (Swedish electronic identification system).

-

-

The service is completely free of charge and is accessible from the Qred application to Qred cardholders. In addition to payment, it allows its users to benefit from :

-

a cash advance to pay their bills without interest for up to 45 days,

-

a 1% cashback offer.

-

-

All invoices are eligible: supplier invoices, stock invoices or energy invoices for example.

-

While the service is free of charge at launch, a fee of 2.5% per transaction will be charged from August 2022 onwards.

CHALLENGES

-

Diversification in stages: Qred obtained a licence to offer payment services in November 2020. Since then (in August 2021), the Nordic region's leading SME financing company has become a member of the Visa Principal programme and thus able to issue Visa card products and programmes. It launched its first Qred card last September and is now realising its ambitions by launching its new payment platform.

-

Continuing to roll out: Since the launch of Qred in 2015, the company estimates that it has financed nearly 25,000 SMEs. Qred offers its loans in Sweden, Finland, Denmark, the Netherlands, Norway, Brazil and Belgium.

MARKET PERSPECTIVE

-

Qred will finance the launch of its new service by raising almost €10 million from a long-standing investor, Nordic Capital.

-

This new round of financing brings the total investment received by Qred to €70.7 million.