Payments service Square launches in Ireland

FACTS

- Better known in the US as "the PayPal of small businesses", Square has diversified its activities while conquering new markets. Today, it is in Europe that it can finally settle.

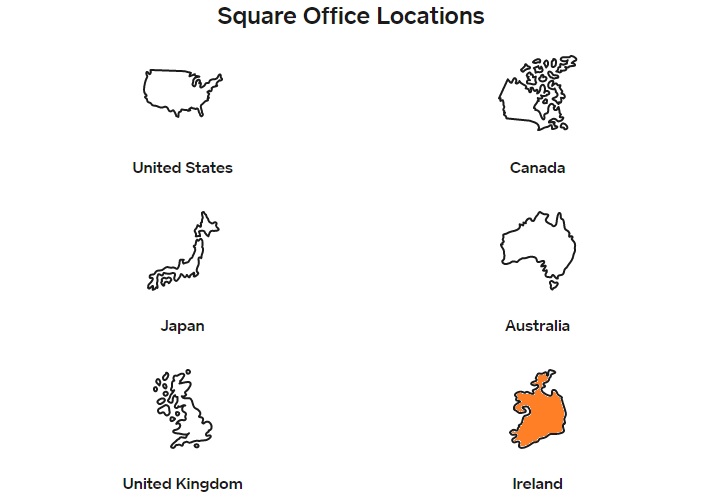

- Founded in 2009 in San Francisco, Square now operates its services in the United States, its country of origin, but also in Canada, Japan, Australia and, since 2017, the United Kingdom.

- Ireland is therefore the first EU country in which the fintech is officially launching, thanks to the granting of an Electronic Money Establishment license in 2020.

- After a pre-launch test phase, all Irish merchants and businesses will now be able to use a full range of services offered by Square:

- point-of-sale cash, charged at 1.75% per transaction in addition to the rental cost of the terminals (Square Terminal (€99 instead of €169), Square Stand €79 instead of €99), and Square Reader (free instead of €19)

- Square Online, which provides an e-commerce platform including merchandise inventory

- a range of commercial tools (billing manager, online payment, team planning, electronic gift cards,...)

- an API platform integrating Square's partners' offers

CHALLENGES

- A wider deployment announced: Ireland is a gateway for Square, which already plans to distribute its offers in other European countries very soon. This acceleration of its presence in Europe could be explained by the opportunities that have arisen from the post-Covid-19 digitalization of commerce.

- Towards a reshaping of the competitive landscape? Until now, Square has left the field open to its European competitors, including SumUp and iZettle. But despite Square's power (in December it exceeded the $100 billion mark in valuation), it will be a big challenge to deploy in Europe. A European Cash App will be up against online banks, neo-banks, and even other growing payment apps like France's Lydia.

MARKET PERSPECTIVE

- Initially focused on the alternative cash market, Square has diversified with the acquisition of Cash App to move ever closer to the concept of universal banking. It has also acquired a Spannish P2P solution, Verse, which could foresee the launch of this solution on the european market.