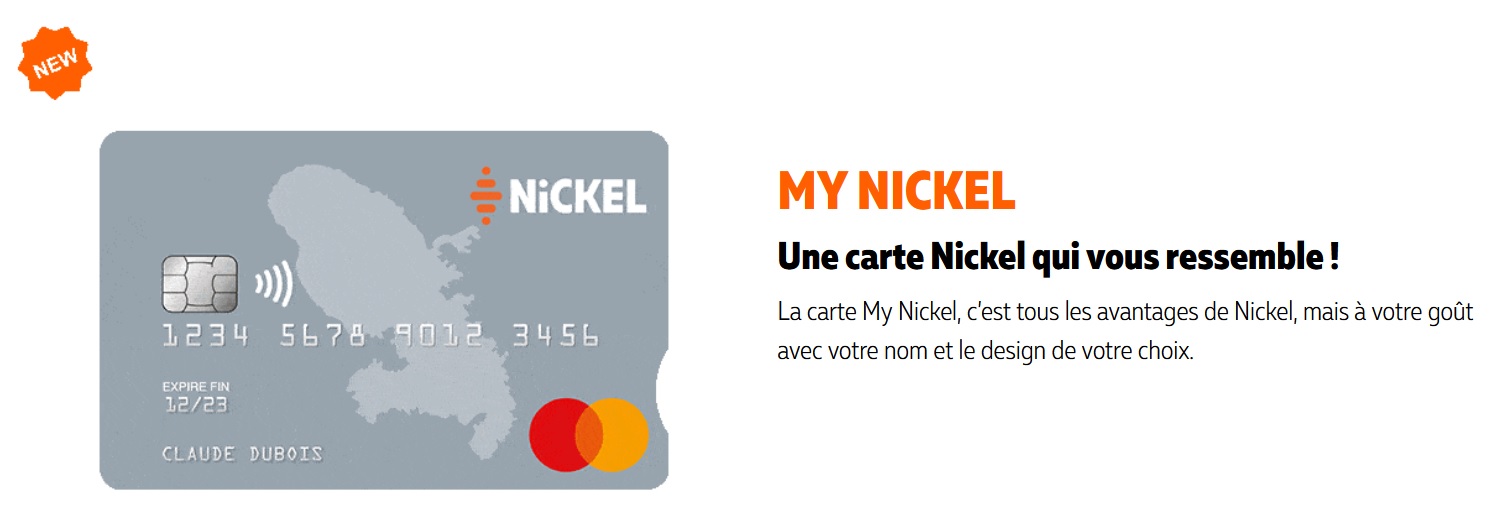

NiCKEL adds a personalized card to its range of products

FACTS

- NiCKEL has just introduced a new card offer called "My NiCKEL". The objective here is to personalize the neo-bank's card with a regionalist touch.

- "My NiCKEL" stands out in its catalog between its standard and premium offers (NiCKEL Chrome).

- The new card will cost its users 10 euros, payable at the time of order, whereas the Standard card is free. This additional cost gives access to a personalized offer on three axes :

- added user name to the card

- choice of color (burgundy, lavender, navy gray, pearl gray, white)

- visual representing a French territory (Brittany, Corsica, Martinique, Guadeloupe, Guyana and Reunion Island)

- The "My NiCKEL" card also has a tactile notch on the opposite side of the chip, making it easier for the visually impaired and blind to handle their bank card.

- To benefit from it, the customer will have to order online or on his mobile application and will receive it within 5 days.

- In addition to the card fee, the account management fee remains 20 euros per year.

CHALLENGES

- Affirming its territorial anchoring: NiCKEL highlights the possibilities of personalization of its card to awaken the regionalism of its customers, thus walking somewhat on the flowerbeds of regional banks. The neo-bank has targeted the 6 French regions most in demand by its customers, but may choose to expand this list later.

- Always count on inclusion: "My NiCKEL" is not only for French people wishing to highlight their region of origin. The design of the card has also been rethought to adapt to the needs of visually impaired people.

- According to the Managing Director of NiCKEL, this decision follows the recurring requests of customers to benefit from a personal and customizable card. The standard card, instantly issued, does not offer this possibility and can sometimes pose a problem for cardholders if the merchant has never seen a non-nominative card.

MARKET PERSPECTIVE

- By March or April, NiCKEL should exceed the 2 million accounts opened in France and is targeting 4 million by 2024.

- The neo-bank also plans to distribute its offer in 10,000 points of sale by 2024 (on average, opening 100 new points of sale per month).

KEY FIGURES

- 3rd largest current account distribution network in France

- over 1.9 million accounts opened, including 140,000 Premium accounts

- more than 6,000 partner sales outlets