NatWest Pay: a Credit Transfer-Based Service for E-Merchants

NatWest, subsidiary of Royal Bank of Scotland, partners with Carphone Warehouse to trial a new “cardless” e-payment solution. This credit transfer-based service cuts down transaction time from a few minutes to just a few seconds.

NatWest Pay connects to Faster Payments, and the bank also considers proposing this service to customers from other institutions via a set of APIs allowing them to share bank information more easily.

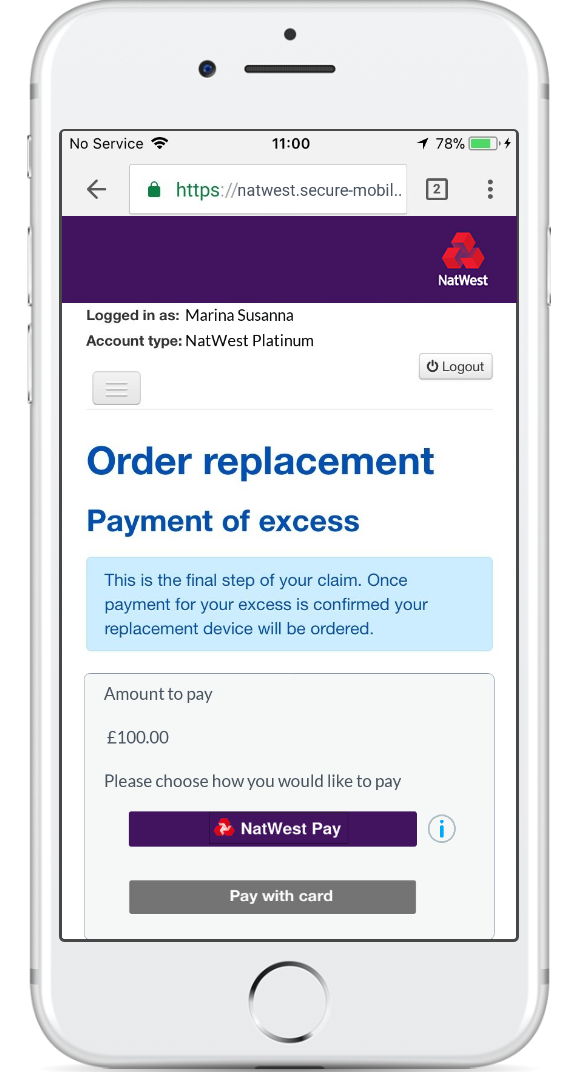

For now, this solution has been made available to iPhone users. At checkout, the customer may choose either to pay by card or using NatWest’s service. When clicking “NatWest Pay”, he is automatically directed to the bank’s website for payment validation. The authentication process relies on Touch ID or his usual password. His bank account is debited and his balance updated in real time.

This service is being tested with the leading European mobile phone retailer Carphone Warehouse. If successful, NatWest plans rollouts via other merchants in the months to come.

Comments – E-payment: credit transfers taking over card payments?

The e-commerce sector keeps growing, and alternative means of payment are increasingly becoming popular. Different methods have been implemented to streamline the payment step and provide e-purchasers with some more peace of mind: virtual cards, for instance. Unlike previous launches which somehow remained card-based, NatWest Pay is a way to remedy this monopoly. This service is easy to use and fast: the customer doesn’t have to key in his card number, and the option doesn’t require 3DS authentication.

NatWest Pay ensures faster payment processes and instantly displays the customer’s new account balance: the initial test phase has been a success. NatWest claims that half of their customers have selected this service when having to pay online. This solution attracted both individual customers and businesses. For e-merchants, it implies lower transaction fees and improved security.

NatWest is the first British bank to feature such a straightforward alternative to card payments for the e-commerce sector, and to implement a near-instant credit transfer service (even if credit transfer options are available in some European countries: in Germany for instance). This feature will have to win more audience and, beyond the initial test phase, face real-life customer reactions.