Moneytrack raises a further €2 million

Moneytrack has developed a platform for organising transactions based on expenditure rules, using smart contracts. Operating on a blockchain, its system makes it possible to organise the advance payment of healthcare costs when third-party payment does not exist. It has just raised funds from a social protection group to continue its international development.

FACTS

-

The start-up's network covers a thousand osteopaths in France and 500 health professionals in Europe.

-

In addition to the French "alternative medicine" market, Moneytrack is also targeting the market of workers living abroad, which represents 3 million French people spending an average of 1,500 euros per year on city medicine.

-

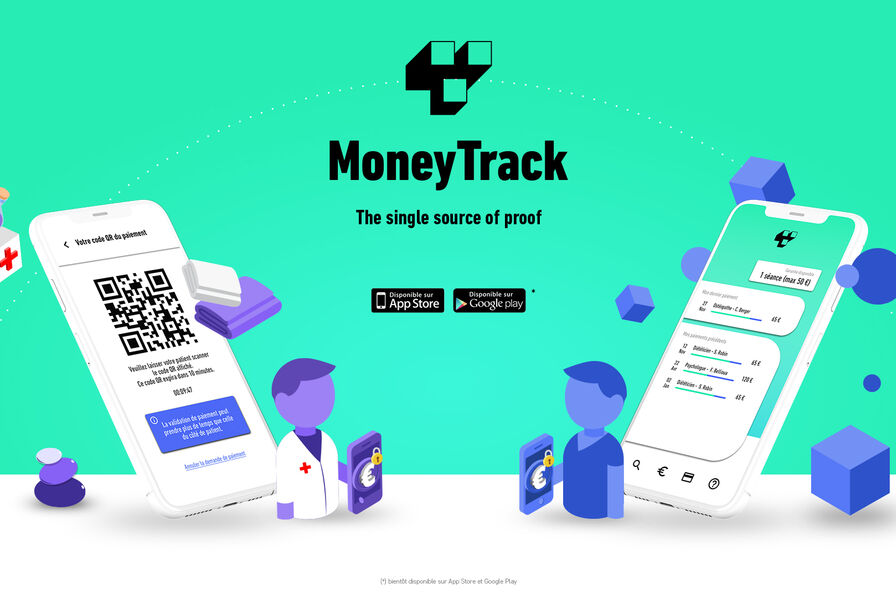

Moneytrack's application works as follows: it is deployed through a network of partner health professionals. At the end of a consultation, the patient scans the practitioner's QR code on the application of his or her mutual insurance company (which must be a partner of the start-up) to generate the payment. Moneytrack pays the health professional directly from an escrow account supplied by the insurer.

-

Its tool has been integrated into some fifteen complementary organisations, such as MGEN and SwissLife (via its subsidiary Owello), as well as various managers such as Assia (ex-Cimut) and Viamedis.

-

Moneytrack had already raised €5.4 million: it has now obtained an additional €2 million in pre-series A financing from its two historical shareholders: the Truffle Capital fund (recently spun off from Particeep) and the social protection group AG2R La Mondiale, via its ALM Innovation fund. The investment fund Accurafy4 has also become a shareholder.

CHALLENGES

-

A profitable business model: The rights and authors of the transaction are verified during the process. According to the company, this system reduces the cost of settling an invoice from 5 to 6 euros for the insurer to 2 euros. The start-up is paid by the invoice and records 1.5 million euros in annual recurring revenue. The start-up's network covers around 1,000 osteopaths in France and 500 health professionals in Europe.

-

Accelerate its deployment: The new funds should enable Moneytrack to accelerate the rollout of its offer internationally as well. An initial trial was recently launched in Spain and Portugal for SwissLife policyholders, but the fintech also plans to launch in Germany, Belgium, Italy, the Netherlands and the United Kingdom.

MARKET PERSPECTIVE

-

In the longer term, Moneytrack is thinking of exploiting the "directed payments" seam to diversify. For example, by opening a vertical for local authority subsidies for soft mobility, which would allow a sort of third-party payment to be applied to the purchase of an electric bike instead of presenting the bill and then taking advantage of the bonus.

-

Prepaid cards are another example of a tool that is increasingly being used to address issues of care, food or accommodation expenditure in social welfare contexts. They have the advantage of being more agile and simple to set up than directed payment systems. The fintech Soldo has just won a tender to equip the British public sector.