Mobile Payment: Official Launch for Beem it

In October 2017, the three largest banks in Australia joined forces to create a mobile real-time interbank payment solution as a response to Apple’s denied them authorisation to access their NFC feature. The app called “Beem it” is officially being introduced following a successful one-month pilot phase.

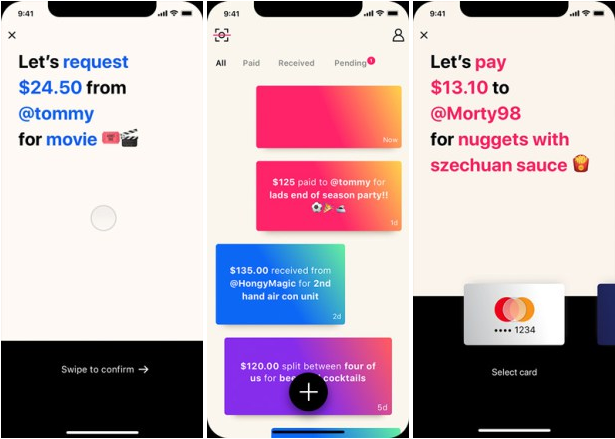

This app in iOS and Android allows its users to initiate instant payments between accounts held by individual customers or companies, regardless of their choice of banks. It relies on the Australian banks’ proprietary EFTPOS technology enabling customers to make card-based transfers. These customers must hold a Visa or Mastercard debit card to use this service. At launch, Beem it offers a $5 welcome gift.

This messaging-style solution allows users to send money, messages and emojis. They may also send payment requests, or split bills between several accounts. However initially crafted with P2P payments in mind, the consortium plans adaptations to address in-store transactions, so Beem it would directly challenge Apple Pay, Google Pay, and the like.

In less than a month the app has been downloaded more than 10,000 times and has ranked 30th on the list of most popular financial App Store apps, without even having run an advertising campaign or made prior official announcement.

Comments – Praising innovation to outpace competition

Considering Apple’s progress most banking institutions have developed alternative solutions. In France, for instance, Paylib and Lyf Pay were launched. In Australia, banks have resorted to their local regulation authority prior to reacting with an innovative launch of their own. They intend to stand out on a market where smartphone penetration rates are among the highest and contactless payments account for 80% of all transactions.

Unlike wallets designed by tech giants (Apple Pay, Google Pay, Samsung Pay, etc.), Beem it is available via two platforms (iOS and Android) and isn’t limited to some banks only. However, this solution requires that both users should have the app installed. The banking consortium bet on a real-time solution to stand out and is already considering merchants’ needs to fine-tune this service and address P2M transactions, as well.