Metro Bank: Full Focus on Ready-to-Go, Instant Services

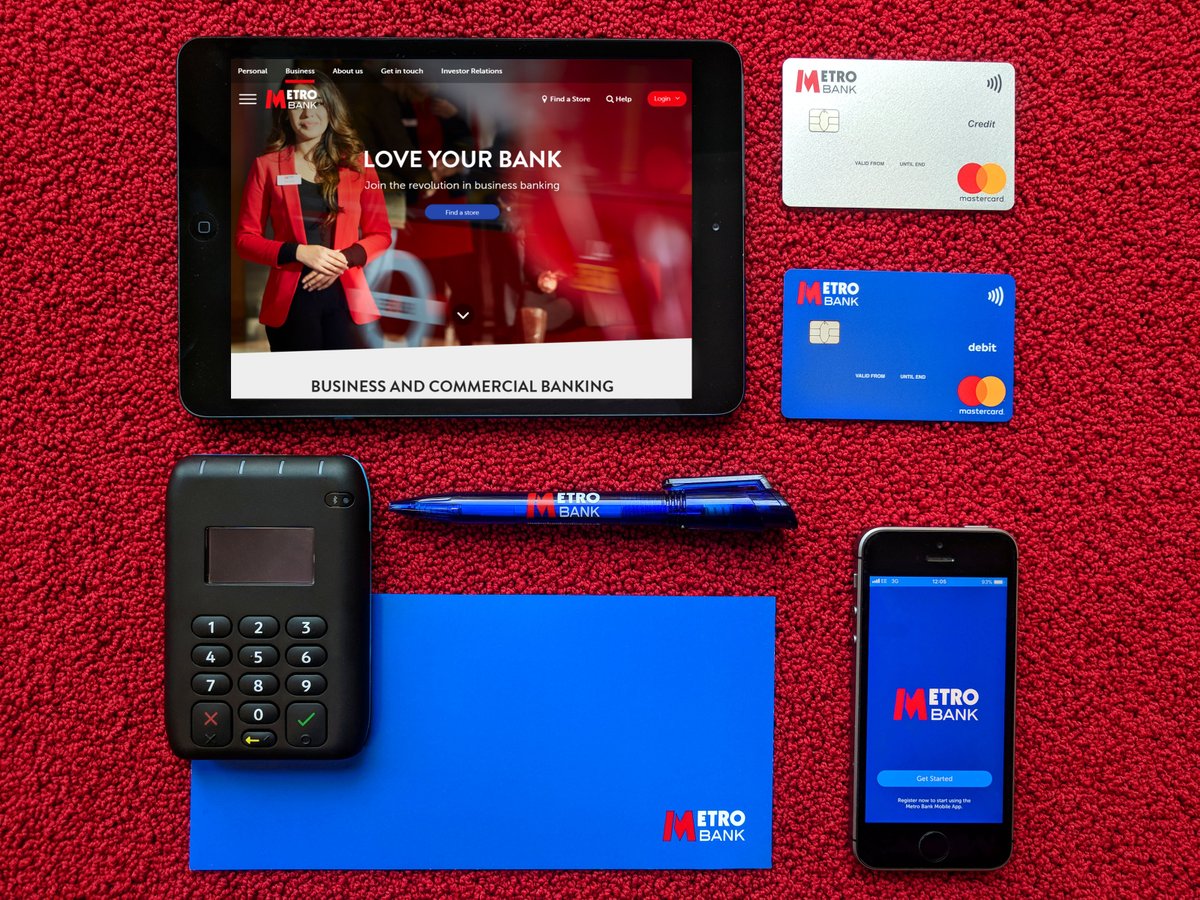

The British bank Metro Bank already proposes instant issuing services for individual customers, where the account opening process only takes 15 minutes and people can just walk out with their cheque book and payment card. They are now adding in-branch instant services for business customers, too, enabling merchants to instantly accept card-based payments as soon as their account is open.

This service called “Walk Out Trading” has been designed in partnership with Acceptcards. Metro Bank’s trading business customers can have their current account configured on-the-spot, without even needing to make an appointment, and lets them accept card payments right away.

This offer includes a payment terminal to be linked to a smartphone or tablet. The non-binding subscription-based service costs £99 upfront, or £6.50 monthly rental fee for the terminal. A 1.75% flat rate is then charged for each transaction. A free online portal has also been made available to these customers, enabling them to track payment activities across all channels.

Metro Bank’s branches are open seven-day-a-week, with early-to-late opening hours. Their new ready-to-go “Walk Out Trading” service started being rolled out in 10 of their stores, and should be proposed across their entire network by the end of 2018.

Comments – Instant services for value addition in bank branches

For newly founded companies, being able to accept payments in no time can be a critical pain point. Considering their customers’ evolving expectations, and interest in adopting instant, customised services, Metro Bank tries to meet these new needs. They claim they are the first bank to propose an instantly operational card acceptance solution.

Metro Bank has always counted instant services and fast response requirements among their top priorities. They already allow business customers to open a BtoB account instantly in their branches, and just walk out with operational means of payment. This service contributed to making them very efficient. Yet, nearly 70% of the business accounts opened in the UK are held by the local “big four” (HSBC, Barclays, RBS and Lloyds Banking Group). Metro Bank’s technology and their brick and mortar network can ensure a competitive edge when facing these leading institutions. This new service is also a way to add further value to their network of branches.