Market Pay adds link payment to its Soft Pos solution

While the payment industry is full of newcomers, Market Pay, a pioneer in Soft Pos payment solutions, has introduced a new innovation to simplify mobile payments, with payment links accessible via QR codes. This new feature will allow Market Pay to stay ahead of the curve and establish its status as a pioneer.

FACTS

-

Market Pay, a startup offering an omnichannel payment solution for businesses, launched PayWish, its Soft Pos acceptance solution, in June.

-

In addition to contactless payment, it now offers a link payment method.

-

Customer journey:

-

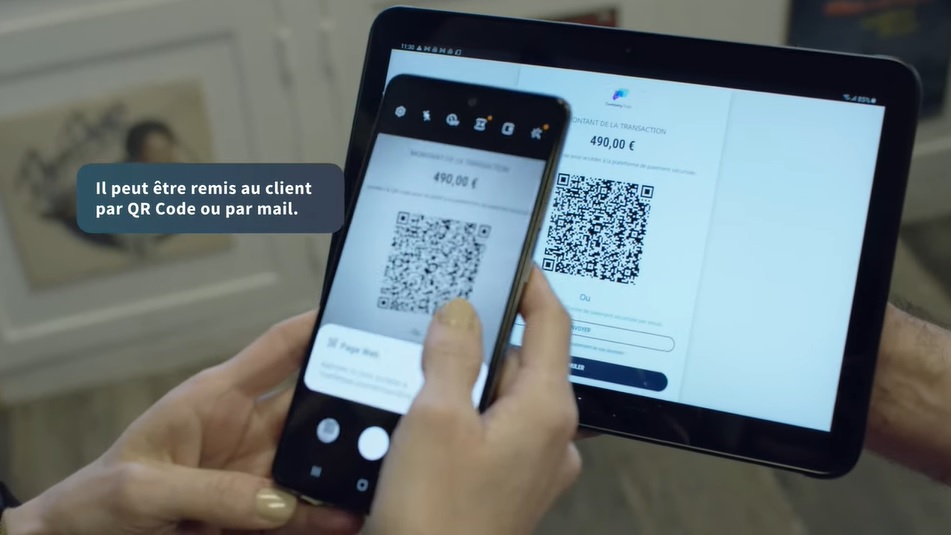

A link is sent to the customer by email or scanned by the customer via a QR Code automatically generated on the merchant's mobile terminal.

-

This same link redirects to a payment page where the customer can choose their payment method: bank card or simplified transfer.

-

The entire transaction is carried out on a single terminal. It does not require any additional hardware. PayWish considerably facilitates mobile sales experiences, whether at the point of sale or outside (home delivery, mobile sales, VTC, etc.).

CHALLENGES

-

Simplify mobile checkout: Mobile sales experiences are becoming more common with the multiplication of order taking in queues, pop-ups and sales corners, and a greater need to optimise the sales area, outside of the healthcare context. The annual growth rate of mobile payment systems is estimated at +20% until 2024.

-

Innovating to remain relevant in the face of fierce competition: In addition to new payment methods, PayWish's functionalities continue to expand with the arrival of cashback and deposit taking. These payment methods will gradually be enhanced with new options such as BNPL (But Now Pay Later).

MARKET PERSPECTIVE

-

Many players (digital payment players such as Stripe or Adyen, tech or e-commerce giants) are currently entering this cash-out market, which increasingly appears to be a crucial moment for the user experience at the payment level and also a generator of essential data, for merchants and financial players, to better understand their customers' needs.

-

To serve these banking and non-banking customers, Market Pay offers a state-of-the-art mobile payment experience, the Soft Pos, integrating the latest innovative payment features.