Lovys: Subscribing an Affinity-Based Insurance

FACTS

- Lovys was introduced in September 2017 and crafted an app enabling customers to subscribe needs-based insurance products, with no time commitment applied.

- This service is only available via the InsurTech’s website and, for now, only provides access to home insurance services an option which covers smartphones.

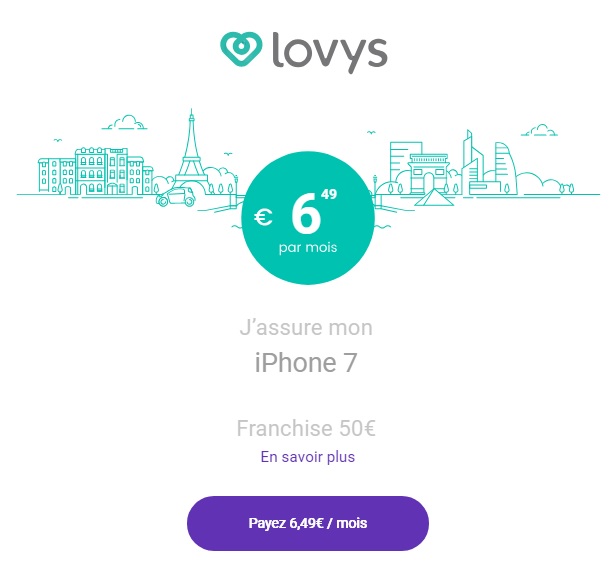

- Cost: Lovys deemed that their proposed prices are 40 to 50% less expensive for smartphone insurance and 10 to 20% cheaper for home insurance offers (Example: €6.49/month to insure an iPhone 7).

- Customer process. when applying for home insurance, the user must:

- Specify his home address and e-mail

- Specify the type of property (flat, house, or residency)

- Once the first monthly fee is displayed (in less 2 minutes) along with basic guarantees, he may customise his contract via addition options (school insurance, electrical damage, etc.).

- Besides these customised contracts, Lovys’s invoicing procedure also stands out. This start-up features non-binding monthly subscriptions. Eventually, the idea would be to include all contracts subscribed by their customers, applying an all-inclusive monthly fee and allow them to terminate their contract from month to month.

CHALENGES

- More distribution partnerships. Until now, this start-up has only been provided broker’s status. By way of crafting more services and expanding their business, Lovys relies on various partners, including insurance companies (La Parisienne, Generali, Cardif, Helvetia and Maif –whose offices they also share).

- The InsurTech focuses on acquiring new customers, and aims for BtoBtoC expansion: partnerships would already be in place to achieve this goal.

- They already raised €400,000 and, by way of financing their growth, could be starting another more substantial funding round in the weeks to come. They would also be getting ready to add a car insurance offer (in partnership with Maif).

MARKET PERSPECTIVE

- Lovys was incubated by Techstars and BNP Paribas (FinTech Boost). They were recently awarded a prize for promising start-ups at South Summit 2018. They now aim to include every property insurance option.

- The market for affinity-based insurance offers is likely to witness strong growth, and room has also been made for on-demand insurance services. Trov, for instance, allows its subscribers to insure their smartphone or camera in case of loss or theft when leaving for a holiday. This enhanced flexibility does match customers’ expectations.