Line Officially Launches a Credit Offer

FACTS

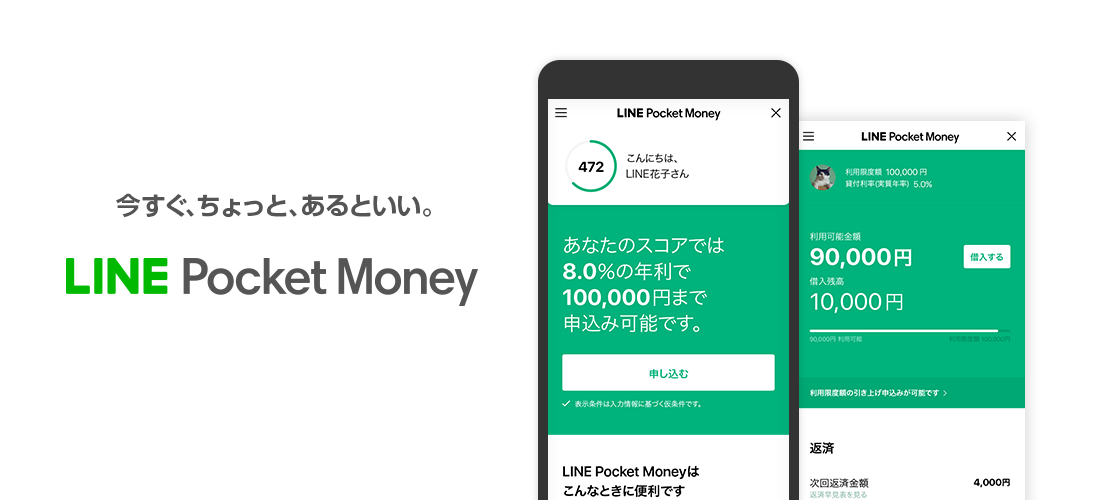

- The instant messaging app Line now features consumer lending services, too.

- “Line Pocket Money” is available for Android and iOS users with a Line Pay account. Line Pocket Money and Line Pay are linked so they can handle the entire process (from applications to repayments) via Line’s mobile-based messaging app.

- Customer process:

- From Line’s mobile app, users visit the “Wallet” tab, then “Score”, and agree to the GTUs.

- They have access to their credit score assessed by Line and may apply for personal loans via “Line Pocket Money”.

- Once their application sent, Line specifies the maximum amount they can be lent and assigned interest rates.

- Users may then monitor their application, up until the approval is notified.

- They choose the amount they need to borrow, sign their contract, and the amount is credited to their Line Pay wallet.

- Their monthly repayments are automatically debited from their Line Pay account.

- Loans can range from 50,000 to 1 million yens (roughly €430 to €8,580), over 1 to 60 months, with APR from 3 to 18%.

- Scoring: Line relies on conventional scoring tools from partner banks (Mizuho Bank and Orient Corporation) as well as on their own analyses through Line Score.

CHALLENGES

- Expanding their range of services. Line teamed up with Mizuho Bank last year, and confirms their micro-lending and micro-saving offers have been designed. These options are meant to enhance their set of offers based on the ecosystem they built through their messaging service.

- An option for coping with unplanned expenses. Line is now one of the “Big Techs” enabling their customers to apply for credit lines (Xiaomi was also added to this list very recently). The point is to make the most of their customer knowledge, based on how their use the messaging app (or their mobile phone for Xiaomi).

MARKET PERSPECTIVE

- Line manages to complete a development plan and keep their promises through launching this microcredit offer announced in 2018 (when they teamed up with Mizuho Bank). They also designed their own scoring tool.

- This Japan-based company claims roughly 80 million active users (vs 78 million in 2018), enjoying both success and trust on the Japanese market.