Klarna opens bank accounts in Germany

FACTS

- Klarna, the Swedish split payment specialist and world-renowned unicorn, is now continuing to diversify by launching bank accounts in Germany.

- A welcome diversification at a time when deferred payment is under regulatory fire.

- Klarna's customers will be able to host their revenues on this account to track their finances, categorize their expenses and analyze their flows.

- Offer's Content:

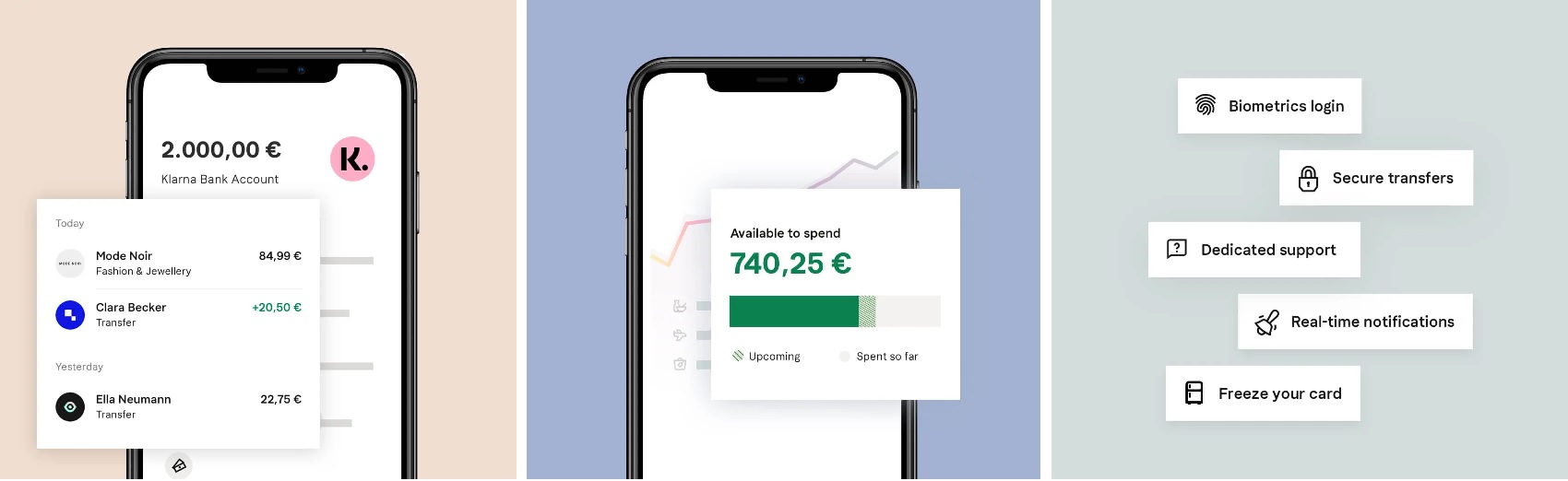

- Simplified account opening from the Klarna mobile application

- IBAN

- payments by credit transfer or direct debit for the 36 countries of the SEPA zone

- Visa debit card (2 colors available)

- Associated services:

- Smart Budgeting functionality, for setting monthly budgets

- 2 free cash withdrawals per month, including abroad (the following are charged €2 per transaction)

- access to Apple Pay and Google Pay

- Pricing: no account opening fees or management fees.

CHALLENGES

- Klarna now wants to offer a complete experience to its customers, like a super app, from shopping to payment, tracking purchases and finances with PFM tools. A savings offer is also under consideration, based on the model of the one launched in Sweden a few months ago.

- Anticipate a backlash on the Buy Now Pay Later Market? Split payment, everywhere in Europe, has become so widespread since the health crisis that abuses have begun to emerge, despite the safeguards generally in place among the major players. This is what led the British regulatory authorities to tackle the problem, in the form of a guide published by the FCA. While the measures envisaged will inevitably have an impact on the margins of Klarna and its competitors, this is not the end of the business. However, the FCA's measures should inspire other European regulators, notably France. In this context, the diversification of Klarna, already started months ago, is of strategic importance.

- Continuing to diversify: FinTech is experimenting with retail solutions in its Lab dedicated to innovation, with a strong focus on transforming the shopping experience, on which it has positioned itself with the launch of its own application in 2020.

MARKET PERSPECTIVE

- For this launch, Klarna is relying on a Bitkom study from 2019. According to this study, 7 out of 10 German consumers would conduct their banking transactions online and would be more sensitive to the quality of the digital offers provided, rather than to the name or nature of the organization providing them. An opportunity for Klarna to establish itself alongside the historical banks.

- Test and co-create via an iterative approach: initially, only a limited number of consumers, already loyal customers of Klarna, will be able to access this new bank account. This limited number of customers will allow Klarna to test its product, benefit from feedback and exchanges with its first customers to improve, before a wider deployment in Germany in the coming months.

IDENTITY CARD

- 2005: creation

- more than 200,000 retail partners

- 10.65 billion dollars in valuation

- more than 3,500 employees

- 17 countries covered