imagin integrates Bizum into its solution for under-14s

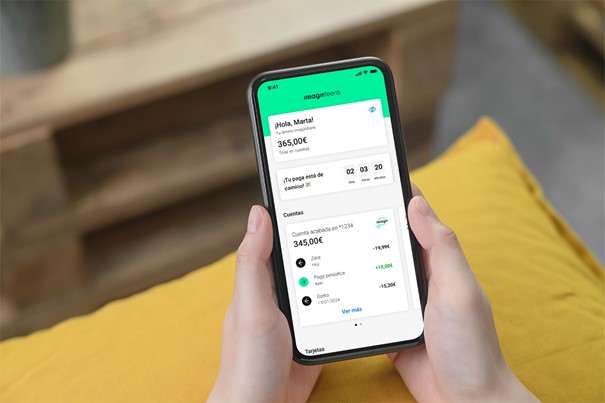

imagin, CaixaBank's digital services platform, has recently added Bizum's services to its imaginTeens app for young people. The platform is thus expanding its services to become more than just a financial application. In addition, it positions itself as an educational and advantageous solution for young people.

FACTS

-

CaixaBank has announced the integration of Bizum into imaginTeens, the application dedicated to young people on the imagin platform.

-

Bizum's functionality is specifically aimed at young people aged 14 and over. They will be able to send and receive money directly on the imaginTeens app.

-

As a reminder, the imaginTeens app, aimed more broadly at teenagers aged 12 to 17, offers a range of services for managing personal finances online. This solution includes :

-

A free account;

-

A card of your choice (debit, prepaid or youth), also free of charge, equipped with a mobile payment option and usable abroad;

-

An application designed to help you learn how to manage your money, with a real-time view of spending and the option of creating savings piggy banks.

-

The imaginTeens solution also provides parents with an overview, enabling them to monitor and manage their children's products. Via the CaixaBankNow application, they can control spending and cash withdrawals, as well as encouraging young people to save through savings solution challenges.

-

When young people reach the age of 18, they automatically become imagin customers and keep their existing products free of charge.

CHALLENGES

-

Giving young people greater autonomy in their financial management: According to CaixaBank, imaginTeens has been designed to help young people manage their money by giving them greater autonomy. To achieve this, the solution offers educational content and discounts on brands popular with the younger generation.

-

The ambition to become more than just a banking application: CaixaBank sees its online solution as a genuine lifestyle platform, positioning it as a day-to-day support service for the under-30s. In the same way as players such as Lydia or even Klarna to some extent, imagin is mobile-only, free to the user, and offers increasingly varied services. By integrating solutions such as Bizum, imagin is demonstrating its ambition to become, in time, a super-app.

MARKET PERSPECTIVE

-

According to the Spanish bank, the application now has 4.2 million users. There are several reasons for this success:

-

Easy access to the solution, with quick registration via the app;

-

The possibility of multi-level use, with services accessible to non-customers;

-

A variety of alternative services with an integrated shopping platform, imaginMusic functionality with music content, or imaginPlanet functionality to integrate an engaged community.

-

Bizum didn't arrive on the imagin app by chance, since CaixaBank had already integrated the mobile payment solution in July 2023 into the functionalities of its CaixaBankNow online bank. So it's only logical that imagin should also offer Bizum's solutions.