Adyen unveils fraud figures for French retailers

Adyen has once again carried out its annual study of the world's retail sector, focusing in particular on the issue of fraud. Unsurprisingly, the year 2023 saw a dramatic increase in payment fraud. The study shows, however, that merchants and consumers are gradually becoming aware of the importance of being vigilant, and are gearing their choices to the risks involved.

FACTS

-

Last week, Adyen published the results of its 2024 Retail Report, covering the year 2023 and carried out in collaboration with CEBR (Center for Economic Business and Research). The report provides a global overview of the state of fraud in the retail sector.

-

On a global level, the report explains that almost half (45%) of the world's retail companies were victims of fraudulent activity, cyber-attacks or data leakage during 2024. This represents a 32% increase on 2022 figures. In France, the increase is even 56%.

-

In France, the retail sector is estimated to have lost 17 billion euros in 2023:

-

2.4 billion in losses for the luxury sector,

-

More than 2.2 billion in losses for the sports/outdoor goods sector.

-

Consumers have not been spared either. Globally, 35% of them were victims of payment fraud in 2023, compared with 23% in 2022.

-

The amounts involved have also risen sharply: in France, the average amount lost by a consumer to payment fraud was 601 euros in 2023, up 241% on 2022 (175 euros), according to Adyen.

-

The study was carried out on over 38,000 adults from some twenty different countries. Over 13,000 retailers responded to the survey.

CHALLENGES

-

A lack of reaction on the part of some companies: Although almost half of companies worldwide and in France are considering switching payment service providers to more secure services (54% and 43% respectively), Adyen points out that only two-thirds of companies (64%) responded that they have effective fraud prevention systems in place. A relatively low figure, given the scale of losses due to fraud. Nevertheless, growing customer interest in secure payment solutions should motivate companies to invest in effective solutions.

-

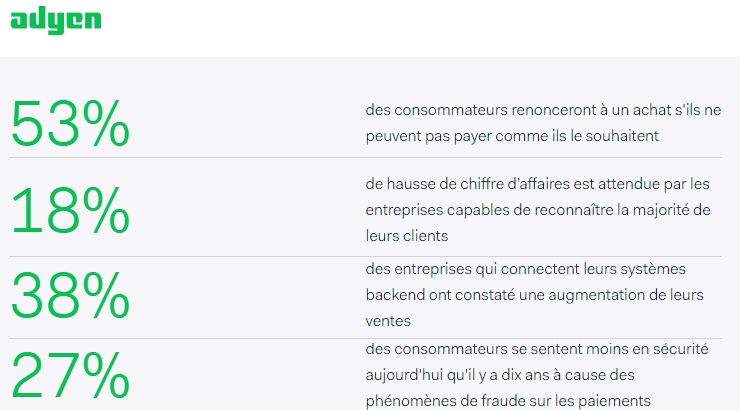

Paradox of consumer payment behavior: While the trend seems to be towards ever more frictionless and rapid checkout, the study shows that the rise in payment fraud is having a real impact on consumer behavior, both online and in-store. Indeed:

-

Nearly a quarter of consumers worldwide (24%) choose a store if it has high security measures in place (compared with 18% in France).

-

22% appreciate the fact that retailers ask for identity verification via different means, even if this lengthens the checkout process (17% in France).

-

MARKET PERSPECTIVE

-

The study shows that businesses are generally sensitive to payment regulations. Within the European Union, the sector is likely to undergo changes in the next few years, as the third Payment Services Directive (PSD3) is currently under review. More than half the companies surveyed (55%) said they were considering how to comply with this forthcoming directive.

-

The rise in fraud is explained by the ability of fraudsters to develop new techniques and outwit anti-fraud systems. To reduce the difficulty of recognizing these new fraud methods, companies are increasingly relying on artificial intelligence. Mastercard, for example, has launched a generative AI developed and trained to combat transaction fraud.