GoCardless integrates access to its international payment network

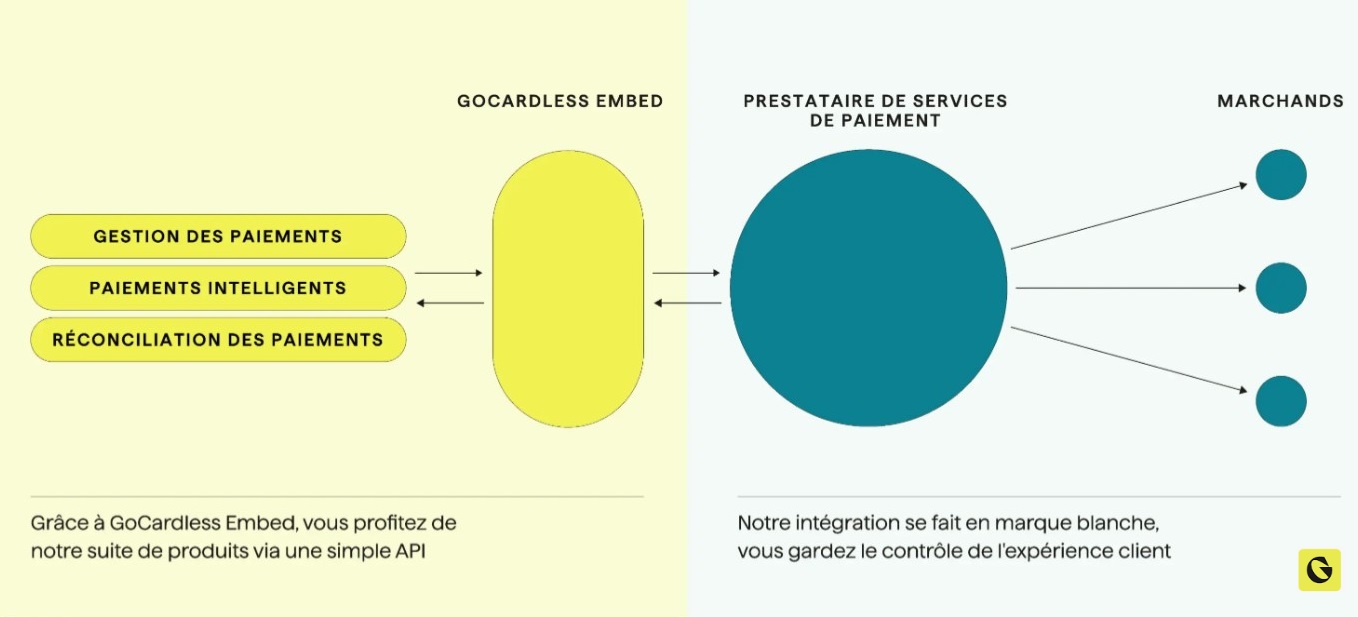

After verified mandates, fintech GoCardless, a leader in account-to-account payment solutions, is moving further into banking-as-a-service with the launch of GoCardless Embed, a new integration that allows third-party payment service providers (PSPs) to access its global banking payments network and enjoy the benefits of bank-to-bank payments.

FACTS

-

GoCardless Embed is white-labeled and allows PSPs to integrate GoCardless' global credit transfer network directly into their platform via a simple API that provides access to:

-

UK, Eurozone and US bank payment systems, with more to come;

-

end-to-end processing capabilities for bank-to-bank payments, including reconciliation, mandate management, reporting and refunds

-

open banking capabilities, such as instant payments - one-off or recurring - in the UK, instant bank account verification and fraud prevention in all three markets.

-

-

The fintech GoCardless, a forerunner of the open banking movement in the UK, is pushing young players to use account-to-account payments to cut costs, overcome dollar limits and secure transactions.

-

Its clients include many fintechs and insurtechs such as Luko, Plum, Klarna, Pennylane and many others.

CHALLENGES

-

PSPs can use GoCardless Embed to align with customers' payment preferences and expectations:

-

According to a survey conducted by YouGov for GoCardless, in France, ease of use and security, enabled by bank transfer payments, top the list of consumer expectations. 77% of French people would stop shopping online if the process was too complex. 40% feel frustrated when they have to manually enter information when paying online. Finally, 84% say that the protection of their privacy and data is a determining factor in their choice of payment method.

-

As for French companies, bank payments are preferred: still according to this study, six out of ten companies surveyed (62%) choose this method of payment to settle their one-off invoices.

-

Becoming a true payment scheme: "Our greatest achievement is to have created a global bank payment network, linking disparate payment systems into one interoperable network - a challenge that until recently was considered unattainable. Now, for the first time, we have created a product that provides access to our unique network and we are excited about the opportunities this solution offers for the entire chain: PSPs, their merchant customers and end consumers," said Alexandra Chiaramonti, VP & General Manager EMEA at GoCardless.

MARKET PERSPECTIVE

-

The usage economy, towards which many companies in France and Europe are increasingly orienting their business models, such as Decathlon, Pizza Del Arte or BMW. This underlying trend is reflected in the study recently published by Wavestone, which indicates that 27% of consumers in France have already subscribed to a premium or loyalty service from a brand such as Amazon Prime, Fnac+, La Redoute & Moi. This rate reaches 34% among consumers in the CSP+ category.

-

Sofacto, a French provider of subscription management and recurring billing applications based on Salesforce technology, is converging with two of Europe's leading providers in the usage economy, Billwerk and Reepay, to form Billwerk+. This trio, backed by the growth capital investment fund PSG Equity, is becoming a key player in Europe.