Feedback: The French still addicted to the card

The comparator Panorabanques has carried out an exclusive study with the Poll&Roll research institute in order to assess the preferences of the French in terms of payment methods. The study shows that the main goal of the democratization of digital payment methods will be to make people forget about the card.

FACTS

-

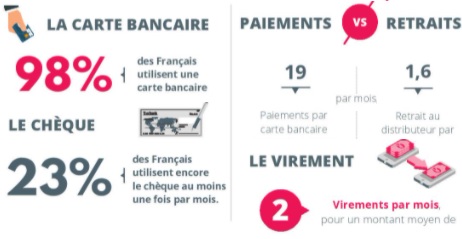

The main finding of this study concerns the bank card, which is the main payment method used by the French. 98% of them use a bank card:

-

48% classic cards (69% Visa and 31% Mastercard),

-

24% systematic authorization cards,

-

22% high-end cards (Premier or Gold)

-

1% very high-end (Infinite or World Elite),

-

2% have Amex or major brand cards.

-

-

In comparison, only 23% of French people use checks at least once a month.

-

As for cash, the French now only make 1.6 cash withdrawals per month, for average amounts of 46 euros.

-

As for transfers, on average, each Frenchman orders 2 each month.

-

On the other hand, although the majority of French banks now offer a mobile payment service, only 17% of French people use them today. The gap in usage between generations is obvious: 27% of 18-34 year olds use mobile payment compared to 8% of those aged 66 and over.

-

The Panorabanques study by Poll&Roll was conducted between August 19 and 23, among a sample of 1,000 people representative of the French population.

ISSUES

-

M-payment in deployment: The numbers are still low when it comes to the use of mobile payment services, but their adoption is accelerating. Only 9% of the French population reported using a mobile payment service last April.

-

Highlighting the consequences of Covid-19: The Panorabanques and Poll&Roll study sought to identify the impacts of the health crisis on French banking habits. On this point; and without surprise, digital channels have largely benefited from the crisis. 16% of French people use more of their bank's online or mobile services to carry out their daily operations. Conversely, one-quarter of French people are visiting their bank branch less often today.

-

Contactless payment, by card, has become more popular with the crisis; 79% of French people now use it.

MARKET PERSPECTIVE

-

By way of comparison, China is a benchmark in the use of mobile payment, where Alipay has become the preferred choice of 93% of Chinese users of this type of solution. But this success in terms of democratization has paradoxically raised the fears of the local government.

-

In France, although the numbers are still low, they are evolving, driven by the momentum of the new generation.

-

It remains to be seen whether the boom in mobile payments will not be overtaken by other initiatives. Today, all eyes are on payment initiation, link payment and RTP initiatives that promise to revolutionize payment worldwide.