Feedback: Swile doubles its losses

For once, Swile, a French unicorn specialising in employee benefits, has had to present its results. Its unicorn status apparently does not protect it from risks, since Swile has recorded a doubling of its losses for the year 2021. This situation underlines the difficulties encountered by this type of player in reaching profitability.

FACTS

-

Swile has thus made its balance sheet for the year 2021 public. And the conclusion is clear: if Swile has established itself as a Unicorn thanks to its important fundraising, it is very far from reaching its profitability threshold.

-

And the progression of its losses is particularly noteworthy, since they have doubled between 2020 and 2021.

-

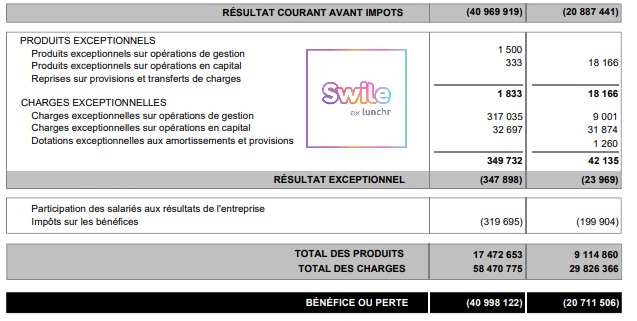

Thus, Swile recorded a turnover of 4.6 million euros, for a net result of -20.7 million euros in 2020. In 2021, the net result will be -40.998 million euros. The reason for this is the costs linked to personnel, which have doubled over a year following a reinforced recruitment policy.

-

The representatives of the FinTech temporise, underlining the fact that the turnover of the Unicorn has nevertheless increased to 11 million euros over the period, and that its annual recurring revenue (ARR) reaches 20 million euros. 20 million. They also expect the Unicorn's business to be profitable by 2024.

CHALLENGES

-

Satisfying its appetites: If Swile had no choice but to comply with the publication of its results, it is because the FinTech entered into direct and exclusive negotiations with its group BPCE to buy one of its subsidiaries: Bimpli. The latter has 5 million end-users, employed in the 75,000 corporate clients of Bimpli.

-

Harmonising an offer: This operation was already planned when BPCE acquired a stake in Swile. At the time, the aim was to eliminate the Bimpli (ex-Apetiz) brand in favour of Swile in order to harmonise the group's offer on the subject of employee benefits.

MARKET PERSPECTIVE

-

The advent of FinTechs and neo-banks will have reshuffled the cards in the financial services market. And the new relationships that have emerged have become more complex. Thus, it is first of all the relations with the historical players in finance that have been ambivalent, halfway between competition and alliance of forces.

-

The second paradoxical point that characterises the FinTech market concerns their success, which is disconnected from any profitability. While some players seem to be doing well today, others such as Swile or Klarna, for example, are reaching unicorn status by increasing their losses from one year to the next.

-

The fact remains that the investors who used to support their model with appetite seem to be less motivated than before to grant their financing (the amount of financing in fintech has thus fallen by 18% in the first quarter of 2022 compared to the last three months of 2021, according to a recent report by CB Insights).