Feedback: Starling Bank confirms its profitability

For once, the British neo-bank Starling Bank recently presented its annual results and confirmed that it had become a profitable business. If the spectre of declining investment in FinTechs is currently weighing on the market, the players already well established would therefore be able to perpetuate their model.

FACTS

-

At the time of its latest results, Starling Bank was proud to announce that it had made its first full-year profit for the year ending 31 March 2022.

-

The neo-bank has increased its pre-tax profit to over £30 million. To achieve this, it can count on the dynamism of its credit activity, after having recorded a 45% increase in loans, to £3.3 billion.

-

Its turnover rose by 93% to £188 million.

-

Starling Bank now has over three million customer accounts, including over 465,000 small business accounts.

CHALLENGES

-

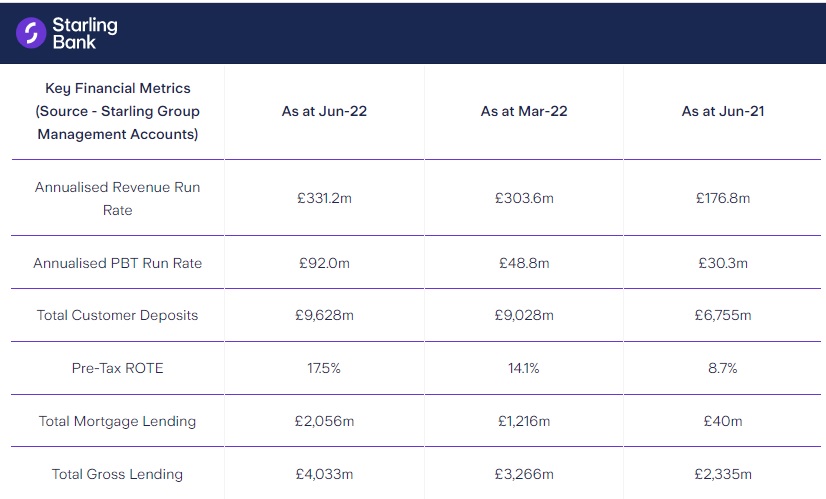

The credit engine: June 2022 reports on Starling Bank's business totalled an annualised revenue rate of £331.2 million, again largely driven by its loan growth, estimated at 72% year-on-year and £4 billion. This gives Starling Bank credit for its acquisition strategy after buying Fleet Mortgages in July 2021.

-

Confirming its good health: Having achieved Unicorn status in 2021, Starling Bank was already expecting its model to be profitable by the end of 2020. Its latest results now seem to confirm this good health, which should continue as in the three months following the end of the financial year, Starling has continued to grow.

-

(R)ebuilding confidence: prior to its good results, Starlign Bank was making a pre-tax loss of £31.5 million in the year to 31 March 2021. In a period marked by a certain mistrust of alternative financial players, Starling Bank is now coming out on top by highlighting its new good results. A way to win the confidence of the public and observers with concrete and traditional arguments: the figures.

MARKET PERSPECTIVE

-

If Starling Bank is an example in the British FinTech market, the picture is not entirely rosy for the neo-bank. In terms of its internationalisation, Starling Bank is indeed facing multiple economic difficulties.

-

After an initial delay due to Brexit, Starling Bank had to postpone its internationalisation project for a second time in March 2021, due to the pandemic. The neo-bank did set foot in France, but opted for a discreet white label positioning. And last July, it finally decided to withdraw its application for a banking licence from the Irish central bank in order to concentrate on its local growth.