Credix organizes loan financing with stablecoins

A Belgian FinTech, called Credix, has big ambitions for the crypto-asset based credit market. It is targeting its offer to emerging countries and more specifically to their local credit companies. Indeed, it plans to put them in touch with investors in crypto-assets in order to renew the sources of financing. A risky bet in appearance but banking on the infrastructure of stablecoins to disrupt traditional investment vehicles.

FACTS

-

Credix has a new offer on the credit market. Its promise? To organise the debt capital market like a blockchain, based on crypto-currencies.

-

It relies on a self-developed next-generation credit platform that connects institutional investors and end lenders (FinTech and non-bank lenders).

-

Funding is tracked on the USDC (US dollar-based stablecoin) blockchain, using smart and transparent contracts.

-

Crédix is already working with companies such as A55 (revenue based financing), Tecredi (car loans), Descontanet (SME financing), Provi (student loans), Adiante (SME financing) and Divi Bank (SaaS financing). All raised debt financing on Credix.

-

On the investor side, Rockaway & MGG Investment Group are now liquidity providers on the platform. Specialised underwriters such as Almavest, Addem Capital and Cauris have also joined them to provide capital.

-

Credix reports already significant growth in its business. Just launched, the FinTech estimates that it has funded $23 million in active loans in just six months.

CHALLENGES

-

A bridge between DeFi and real-world assets: Credix presents a new model for using crypto-assets in the real world. Far from the Metaverse, FinTech seeks to extend the uses and legitimacy of crypto-assets in the economy, as a concrete alternative to specific issues (in this case, loan financing).

-

Conquering South America: Credix has already started its activity in Brazil. It intends to expand in stages, starting with the territories of South America, Mexico and Colombia in particular. Credix hopes to finance $100 million in loans by the end of the year.

-

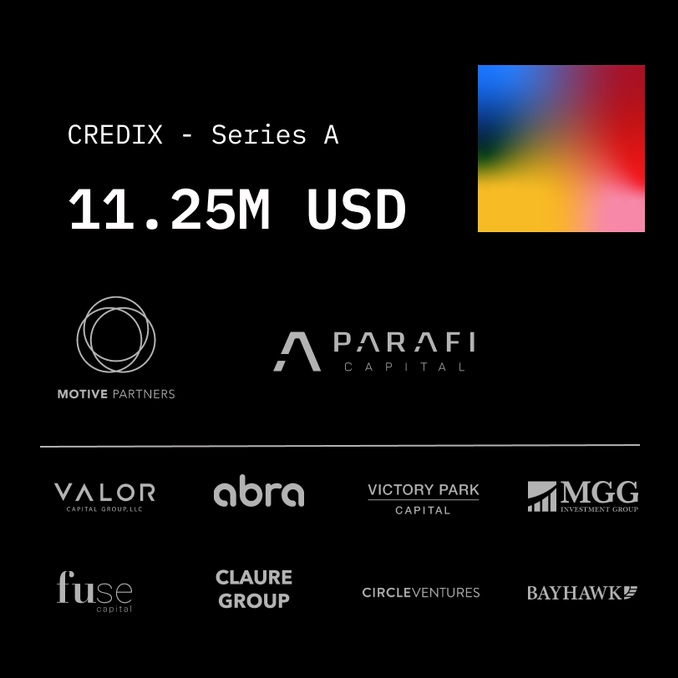

11.3 million was raised in Series A from Motive Partners Early Stage Fund and ParaFi Capital, with the participation of Valor Capital, Victory Park Capital, MMG Investment Group, Circle Bentures, Abra, Fuse Capital, Claure Group and business angel Ricardo Villa Marina.

MARKET PERSPECTIVE

-

South America is a continent that appears to be mature for the development of innovative services based on crypto-assets. A recent Mastercard study estimated that 51% of consumers in Latin America had already made a transaction with crypto-currencies. More than a third said they had also used stablecoins as a means of payment.

-

Faced with the rampant inflation of local currencies (especially their official peso), Argentines have even found crypto-currencies to be a safe haven. The country has many workers who ultimately prefer to receive their salaries in crypto-currencies; 60% of the population believes that bitcoin would be able to maintain the value of their savings for a period of two years.

-

Brazilian e-commerce platform Mercado Libre has just announced the launch in Brazil of Mercado Coin, its own crypto-currency. In this promising context, Credix's offer should find its place.