Feedback: N26 unveils its 2020 results

The German born neo-bank N26, which has managed to establish itself as a FinTech reference in Europe, wanted to start the year by posting its results for the year 2020. This is an important event because it is information that was previously kept secret due to the fierce competition between alternative players, and it is a step towards greater openness and transparency and anticipates the obligations linked to a future stock market listing.

FACTS

-

N26 chose to publish its annual results at the beginning of the year. These results, however, concern its 2020 activity, and show sustained growth for the FinTech. The results for 2021 will be published in the first half of 2022.

-

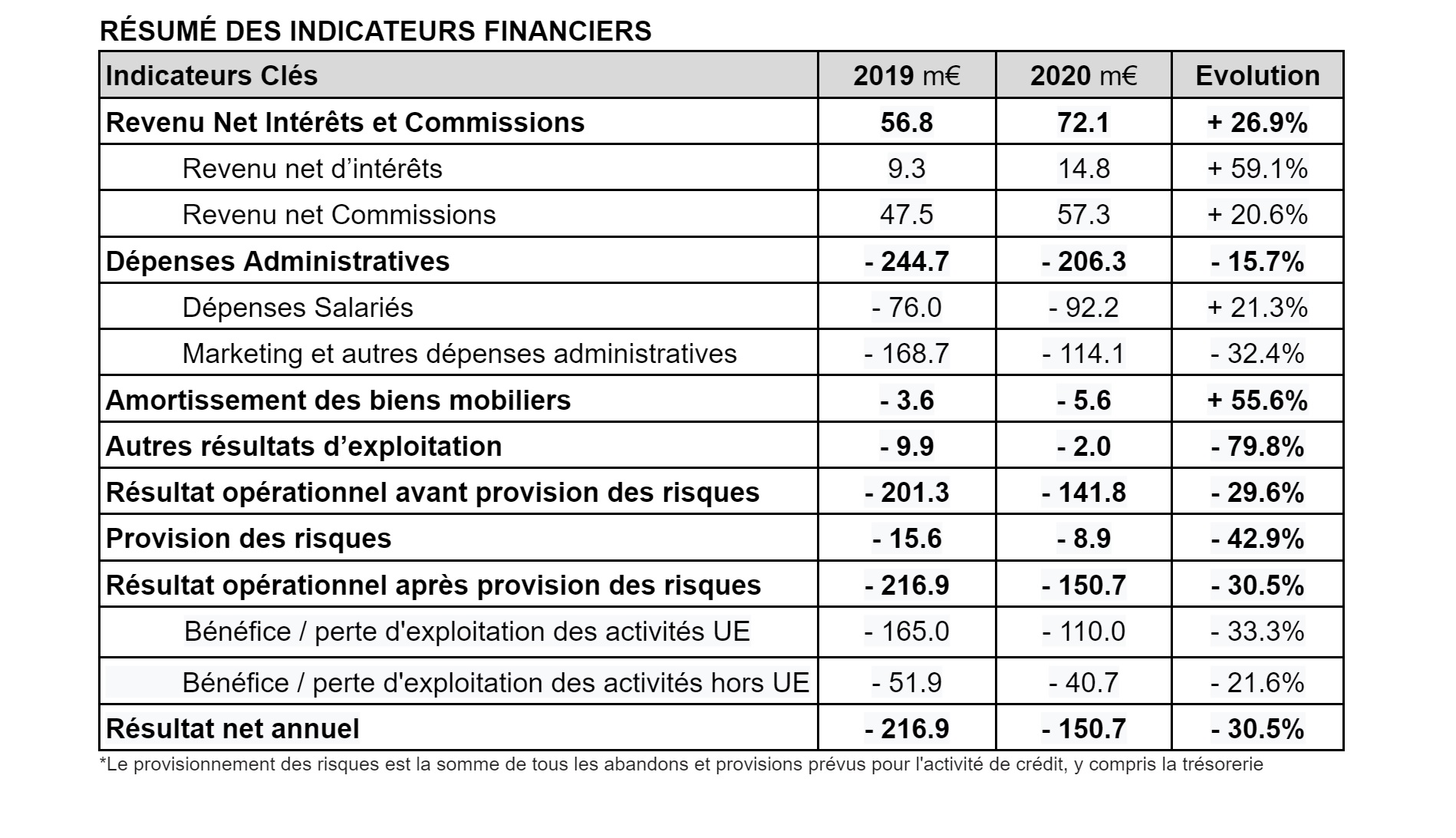

The latter improved its net profit margin by 96 points in 2020, compared to 2019. The FinTech also saw its net losses shrink by 30.5% compared to 2019. Its gross revenue jumped 22% to €112 million; its net losses were reduced by 33.3% to €110 million.

-

N26 saw its balance sheet activity increase by 79% in 2020, to €4.3 billion. And its transaction volume jumped 57% to €50.3 billion compared to fiscal 2019.

-

N26 ultimately identifies three drivers of its growth:

-

the increase in subscriptions,

-

Accelerating account usage,

-

increased subscription to additional banking products.

-

-

The FinTech says it now has over 7 million customers in Europe.

CHALLENGES

-

Putting the black marks of 2021 behind us: 2021 will have been marked by two difficult announcements for N26 in quick succession. The FinTech decided to leave the US territory last November (after having left the UK territory following the Brexit). The year 2021 will also have been marked, for N26, by a sanction for failing to comply with anti-money laundering controls imposed by the German financial supervisory body BaFin.

-

Validating a business model: Subscriptions generated 45% of commission income, driven in particular by the launch of N26 Smart. The FinTech highlights this particular point to validate the relevance of the evolution of its business model.

-

One step closer to going public: In March, N26 applied for a licence to obtain financial institution status from the Bafin, a regulatory requirement before a possible IPO. The neobank would be the first German Fintech to receive this approval.

MARKET PERSPECTIVE

-

N26 published part of its 2020 results at the very beginning of 2021. Even then, the FinTech reported strong growth over the year, driven in particular by the health crisis.

-

In February 2022, however, N26 was unable to publish its 2021 results. The FinTech nevertheless states that they will be unveiled soon, during the first half of this year.

-

It remains to be seen how they will have been impacted by the hard knocks that N26 has had to face. The year 2021 will not have been so bad for the FinTech, which was also able to count on a historic fundraising, in Series E, which allowed it to beat a record valuation.