Feedback: Memo Bank's European ambitions

Avec la crise qui a rattrapé le secteur des valeurs tech et du monde de la finance, la rentabilisation du modèle est devenue un facteur clé. Lancée il y a 5 ans, alors que les PME n'étaient encore que peu et mal adressées par les banques traditionnelles, Memo Bank s'est fixé pour ambition de réinventer une offre bancaire taillée sur mesure pour les PME de plus d'1 million d'euros.

FACTS

-

Memo Bank does not define itself as a neobank or FinTech but as a real bank. It is the only independent French banking group to have obtained a banking licence as a credit institution for 50 years.

-

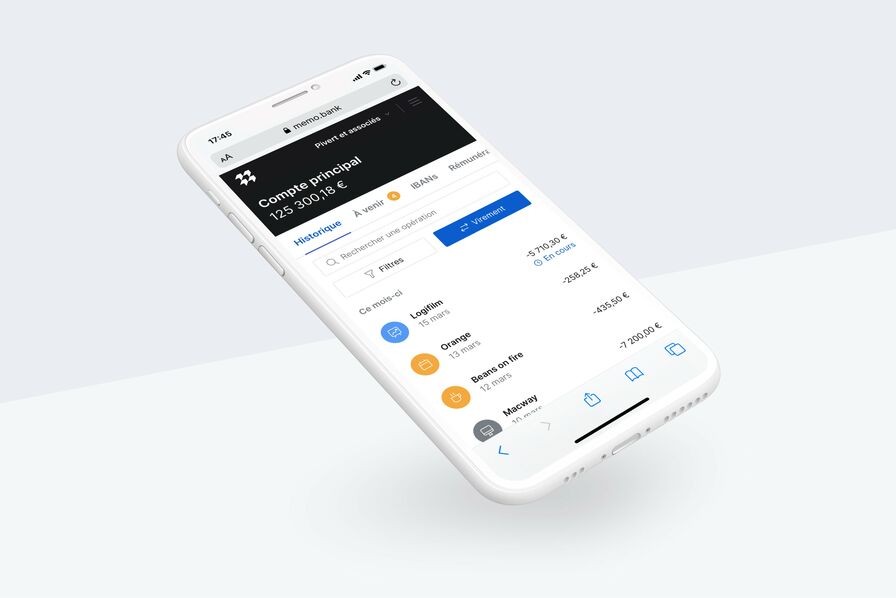

This status enables it to offer its customers a wide range of services, such as a current account, loans, means of payment, grouped transfers, access to IBANs and monitoring of direct debit mandates.

-

Its core target: SMEs with a turnover of more than one million euros. This is a target that is neglected by traditional banks because they represent too much investment for too little profitability. On average, Memo Bank's clients have an annual turnover of between €4 and €5 million and around 15 employees.

-

The start-up, which does not disclose its turnover, employs 65 people. It is expected to raise further funds by 2024.

-

Memo Bank currently claims 300 customers and is aiming for profitability in 2024 with several thousand customers.

CHALLENGES

-

More responsiveness to its customers: Memo Bank has developed an in-house Core Banking System, the IT architecture that forms the heart of the banking reactor, with a single watchword: greater speed and fluidity for its customers. Memo Bank is able to offer instant transfers and standard transfers in 45 minutes at any time, by being connected directly to a European Banking Authority clearing house, which also has the advantage of reducing costs by cutting out intermediaries.

-

Bankers on the ground: The neo-bank that focuses on customer relations, with account managers available on the ground and remotely. For day-to-day operations, like all neobanks, Memo Bank relies on self-care. To make processes even more efficient, in August the start-up launched an API allowing SMEs to automate certain operations without having to go through the customer area.

-

European ambitions: Its ambition is to become the leading European bank for SMEs, because today there is none. To achieve this goal, Memo Bank is expanding its range of banking services and bringing them up to the standard of what the technology players, but also the major traditional players, are capable of offering their customers. Recently, Memo Bank has enabled its customers to receive international transfers outside the SEPA zone, thanks to a partnership with JP Morgan.

MARKET PERSPECTIVE

-

The corporate segment is increasingly being invested by banks, but also by fintechs.

-

Whether it is with Qonto and its European ambitions that the neobank operated with the recent acquisition of the German pro bank Penta or Crédit Agricole is about to launch two new offers addressed to professionals (individual entrepreneurs and self-employed): Propulse by Crédit Agricole and LCL Essentiel Pro.

-

In addition to traditional banking services, many operators are trying to attract this clientele by developing an offer relating to management services that can result from the provision of financial services. This is the case with Fintecture, Pennylane and Libeo.