Feedback: Half of Swiss banks open up to cryptocurrencies

The Swiss financial audit and consulting firm EY (Ernst & Young), has published its 2022 Banking Barometer. It highlights the optimism of the sector at the dawn of 2022 and the confirmation of a basic trend regarding the opening of traditional institutions to crypto-assets.

FACTS

-

The majority of Swiss banks are planning to offer investment products in crypto-currencies. This is the main finding of EY's new Banking 2022 Observatory, with particular reference to the topic of the crypto market. It surveyed 90 banking institutions.

-

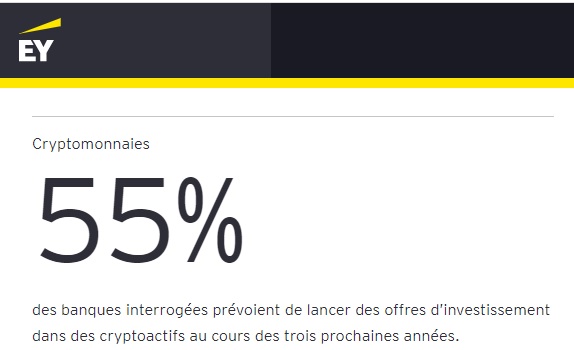

55% of the banks questioned in the framework of this observatory thus specified that they planned to launch an investment offer in crypto-assets in the next 3 years.

-

However, there are differences depending on the nature of the banks:

-

private banks are the most mature on the subject, as 68% of them underlined their interest in this type of digital asset.

-

the proportion of institutions ready to offer their clients an investment in crypto-currencies within three years falls to 50% for cantonal banks and 48% for regional banks.

-

-

More broadly, 55% of banks surveyed said they believe crypto-currencies will establish themselves as an asset class in their own right (alongside equities and bonds) over the long term.

-

52% of banks also said that offering investment opportunities in crypto-currencies does not run counter to their sustainability goals.

CHALLENGES

-

Ahead of the curve: The Swiss market was opening up to the crypto-banking era as early as 2019 and was chosen as the home of the Diem association. The Spanish bank BBVA has also chosen this country to test a commercial platform for buying, selling and keeping digital assets. It recently strengthened its system.

-

An evolution to follow: The craze for crypto-assets is linked to that of clients and the ambition to offer investments with high growth potential. Nevertheless, the Bank for International Settlements (BIS) requires higher capital requirements on crypto-assets held by banks.

-

A bipolar strategy: Although sustainability remains a major issue for the majority of banks, 54% believe that offering investment opportunities in crypto-currencies does not run counter to their sustainability goals.

MARKET PERSPECTIVE

-

Switzerland was one of the first countries in the world to codify digital assets into national law, having implemented the first phase of the so-called 'blockchain' law last year. Finma, the regulatory body for financial activities, was also the first to create a specific establishment status to regulate crypto activities.

-

Switzerland's example is worth following as it highlights a trend that is gaining momentum worldwide. In November 2021, Commonwealth Bank became the first bank in Australia to offer a crypto trading service. Italian bank Banca Generali has also invested in FinTech Conio to offer crypto products.

-

The market value of total crypto-assets in circulation exceeded $2 trillion in September 2021, 10 times more than in early 2020. The International Monetary Fund reports on this exponential growth and the challenges of disintermediation for central banks and commercial banks. It stresses the importance for authorities to issue central bank digital currencies and the need to adapt to technologies to avoid disruption.