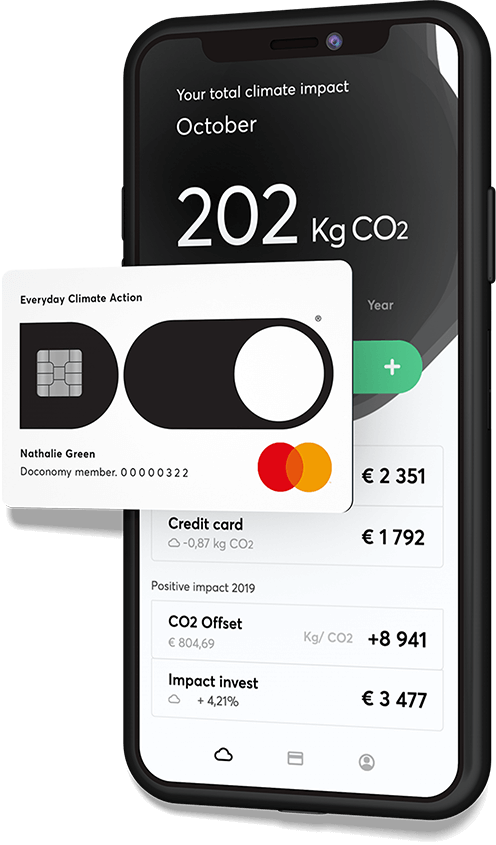

DO Card: a Payment Card for Capping Customers’ Carbon Footprint

FACTS

- The Swedish start-up Doconomy launches a one-of-a-kind payment card in partnership with Mastercard. This tool called Do Black Card lets cardholders track and measure their daily purchases’ CO2 footprint.

- Goals: Reduce users’ expenses impact on the climate.

- Offers: just like other mobile banks, such as N26 or Revolut, Doconomy proposes a mobile app enabling users to monitor their bank account and payment card.

- How it works

- This FinTech relies on the Åland Index by Ålandsbanken to analyse and define the carbon impact of each transaction.

- The user chooses a carbon impact not to be exceeded when making purchases.

- They may also compensate for greenhouse gas emissions induced by their consumption through investing in UN-certified carbon offset projects.

- Besides enabling their users to make up for their CO2 footprint, this challenger bank will be adding cashback offers as “DO credits” for investing in sustainable funds.

- A Beta test phase in underway in Sweden. Other countries may later be addressed. This offer should officially see the day this summer.

CHALLENGES

- Climate crisis. According to the Paris Agreement signed by the United Nations, global greenhouse gas emissions must be halved by 2030 to achieve a climate neutral world by mid-century. By way of achieving this ambitious goal, several players –including Doconomy– bet on enhancing consumers’ awareness through highlighting carbon emissions.

- Game changing card in the age of deconsumerism? According to the Swedish Environmental Protection Agency, consumption accounts for around 60% of all carbon emissions. This considered, Doconomy hopes they can significantly impact people’s relation to consumerism, lead them to favour sustainable options and approaches.

MARKET PERSPECTIVE

- This announcement was made short after the Climate Mobilization Act passed in New York, including a series of bills intended to reduce carbon emissions and mitigating global warming.

- In France, the e-payment FinTech PayGreen crafted a relatively similar solution: an algorithm for assessing carbon emissions owed to ordering online. Customers can then send the equivalent amount to a French association for reforestation.