Cuvva: 2 Minutes for a Customised Travel Insurance

FACTS

- The British InsurTech Cuvva which specialises in on-demand car insurance, expands to travel insurance. Customers may sign up for early access to the Beta version.

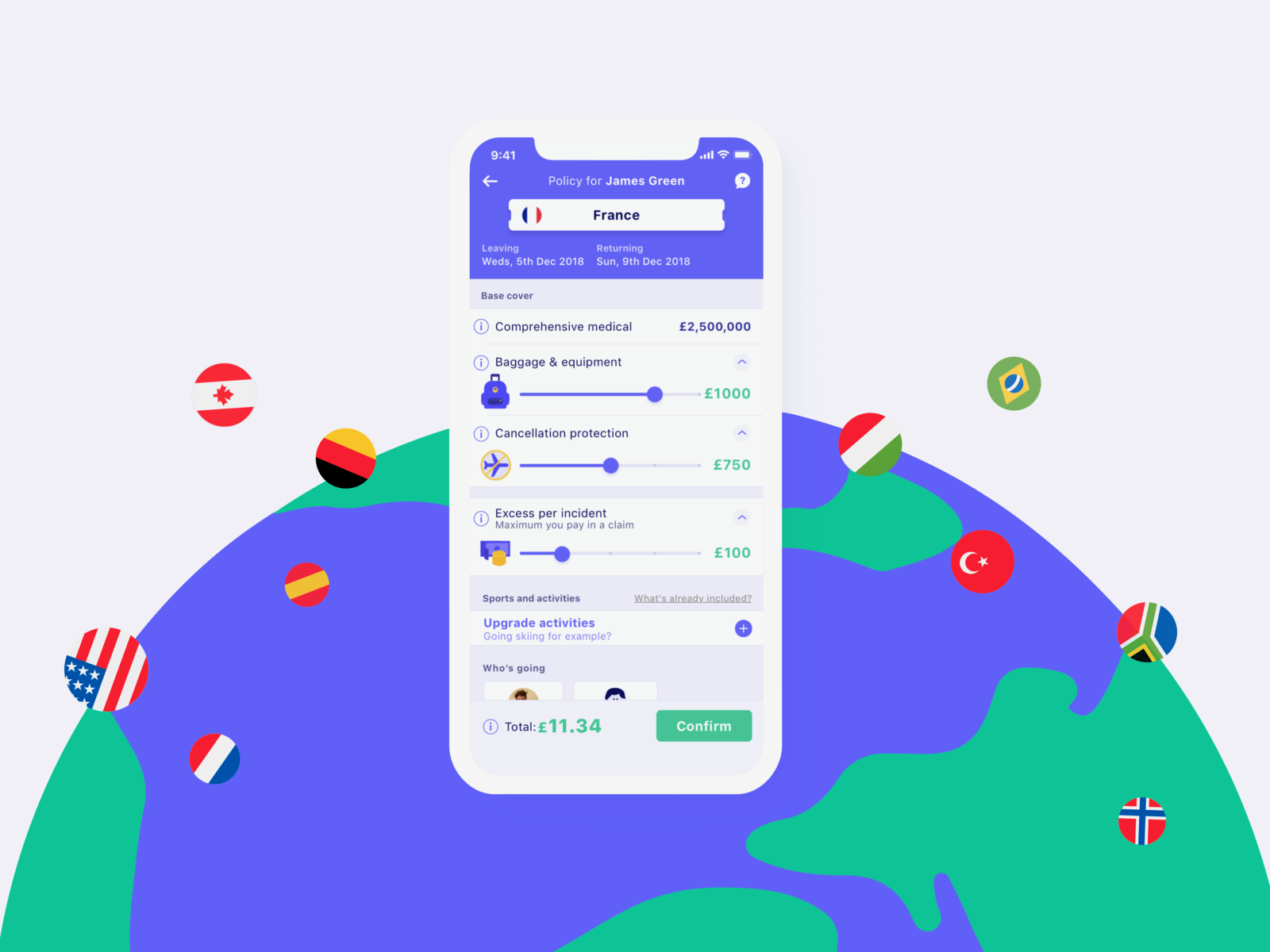

- Cuvva is based on a concept similar to the one they applied for their other offers: an on-demand, simple and flexible insurance policy enabling customers to sign up in a matter of minutes for themselves and/or family and friends when traveling abroad.

- The offer includes:

- Medical cover up to £2.5 million

- 150 sports and activities covered

- Travel cancellation cover (weather conditions, flight delays, etc.)

- Event cancellation cover (festival, concerts, shows, etc.)

- Adjustable number of insured customers

- Prices are assessed based on each contract, the user may:

- Specify assessed cost of luggage and/or sports equipment

- Adjust cancellation cover (flight fare, concert tickets, etc.)

- Adjust the amount of excess to be paid if a claim has to be filed

- Choose a region (Europe or world).

CHALLENGES

- Expanding service offering while upholding similar concepts: simplicity, flexibility and customised prices. Cuvva promises to let their customers sign up for a travel insurance contract in less than 2 minutes: this promise also applies to their car insurance policies. Also, they insist that their customers have access to all required documents transparently and in-app.

- Their consumer support service is available 24/7 all year round; the InsurTech claims they achieved 84% satisfaction level.

- Business model: Partner insurers are changed a finder’s fee as Cuvva acts as an intermediary. Customers are also charged fees.

MARKET PERSPECTIVE

- Cuvva launched in the UK in 2016. They first introduced short-term on-demand car insurance policies from 1 hour to 28-days. These options are mostly intended for customers who do not have a car, helping them address various kinds of emergencies, via instant subscription and contract activation. This idea has since been expanded to include utility vehicles as well as cabs and ridesharing drivers.

- Cuvva also features APIs to make their infrastructure available for vehicle fleet, carpooling platforms and other mobility-focused players.

- In the on-demand insurance sector, travel insurance policies have been used as innovation levers by several industry specialists: long-standing players (AXA with fizzy –their parametric insurance for flight delays– for instance, or “last minute” kiosks at airports) and InsurTechs, alike.

- also stood out early this year when they unveiled a location-relevant travel insurance from £1 per day: this service is automatically activated when the subscriber crosses his country's border. Cuvva, however, stresses a more customised approach: customers may precisely adjust their insurance policy to match their needs.