Company Cards: Pleo Raises $56 Million

FACTS

- The Danish FinTech Pleo announces a $56M Series B financing round from the New York-based growth fund Stripes, and existing investors Kinnevick, Creandum and Founders.

- Decentralise companies' decision-making, enable staff to feel more empowered, based on a prepaid means of payment.

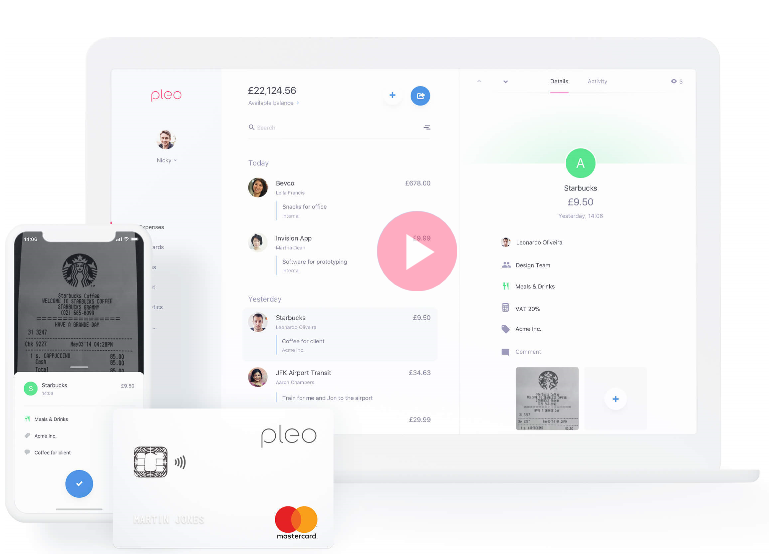

- Pleo was founded in Copenhagen in 2015 by former Tradeshift employees. This FinTech provides smart company cards paired with software and mobile apps.

- Advantages:

- Track corporate expenses in real time

- Automatically label expenses

- Generate detailed analytics

- Streamline bookkeeping and accounting tasks: employees can take pictures of their receipts, create expense reports and directly add them to the accounting software in real time.

- In addition to Denmark, Pleo also entered the UK, Germany and Sweden. They claim 3,500 corporate customers including Lyst, Yoyo, The Tab, Airsorted, Pizza Pilgrims or Roskilde Festival. They also claim that hundreds of businesses are added to this list each month.

- This funding round will be used to

- Speed up the pace of product development plans (credit offers, mobile payments, invoicing, VAT reclaims, etc.) to address SMEs’ entire purchasing process worldwide

- Increase their workforce threefold, from 120 to 400 employees by end-2020.

CHALLENGES

- Changing corporate customers’ habits. Pleo focuses on streamlining business expenses-related procedures for employees and support services. Based on a reassuring prepaid method, they intend to help fight companies’ reluctance to provide payment cards to their employees.

- Retaining employees. Expense reports and associated processing tasks, or their integration with accounting software are tedious steps likely to impact employees’ well-being. Pleo’s solution can be viewed as a tool to improve recruitment and retain workforces.

MARKET PERSPECTIVE

- Less than a month ago, Pleo also announced a $16 million Series A funding round, or a total of nearly $79 million raised over 5 rounds (including seed rounds).

- This start-up is gaining ground on a crowded sector but will have to face competition from other FinTechs. In France, Mooncard crafted a similar offer and aims for European expansion. And Qonto and Spendesk made room for this market, as well. In the UK, Curve stands out as the most active start-up with an all-in-one card including features for streamlining business expense management (through, for instance, integrating with Xero).

- This industry is also targeted by vouchers’ issuers, such as Sodexo for business travel expenses.