Chuck, a new P2P payment network for community Banks

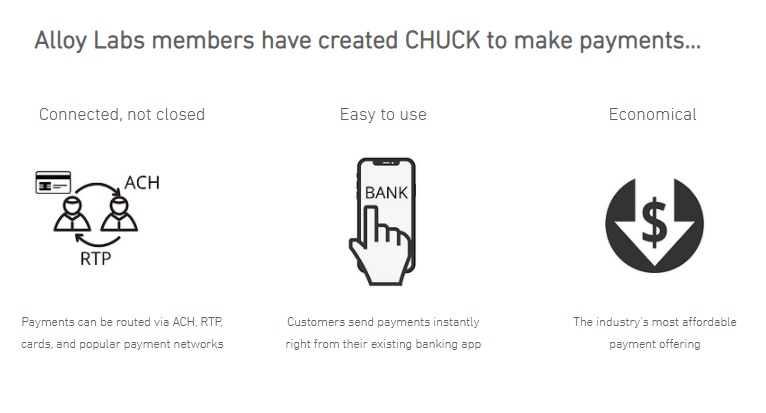

The Alloy Labs Alliance is an association of community and mid-sized banking organisations in the US. It has just announced the launch of a new open network for instant peer-to-peer payments. Called Chuck, this service allows community banks to demonstrate their capacity for innovation and cooperation.

FACTS

-

Chuck is presented as an open, interbank instant payment network, specifically operating transfers between medium-sized banks in the Alloy Labs alliance.

-

Chuck offers financial institutions in the Alliance a new option for managing payment flows between their customers in a secure and accelerated manner.

-

Customers will be able to access the service from their mobile banking application. Chuck will allow them, from this unique interface, to make payments between individuals to different accounts held in banks other than their own or even to popular payment services such as Venmo, Cash App or Zelle.

Alloy Labs is :

12 small banks

over $250 billion in assets

30 million retail customers

6 million small business customers

CHALLENGES

-

Show that community banks can also innovate: To meet the growing demand for fast and easy interbank payments, community banks initially looked to Zelle, the leading interbank service in the U.S. But given the cost of that service, they partnered with FinTech Payrailz to create its own peer-to-peer payment service.

-

Becoming a leader: The new Chuck network aims to become a national benchmark. The Alloy Labs Alliance plans to open Chuck to all US financial institutions in the future. Future connections are also planned for the RTP (Requesto to Pay) network created by The Clearing House and for the FedNow faster payments project, which should be launched in 2023.

MARKET PERSPECTIVE

-

Chuck's ambitions are laudable but will have to contend with a behemoth that is already well established in the interbank consumer payment market. The American service Zelle was launched by the main American banks such as JP Morgan, Wells Fargo and Bank of America in 2016.

-

Very soon after its launch, it announced that it had processed 170 million P2P payments for a transaction volume of almost 55 billion dollars. The question of interbank positioning for payment and money transfer services was thus already at the heart of a fundamental trend, considered to be a new standard in the making, at least for the largest banks in the market.

-

Zelle's success has continued ever since; the payment service set a new record in 2019 and again in 2021, and now counts on interoperability with more than 1,000 US banks.